As widely trailed, today saw Prime Minister Theresa May announce the activation of Article 50 of the Treaty of the European Union, beginning the process of the UK’s departure from the EU. The letter, delivered to the office of EU Council President Tusk, set out some key aspirations for the UK’s terms of departure, and the future relationship with the EU.

Relative to Theresa May’s speech of 17 January – an exposé of the UK’s broad negotiating objectives – the main sources of difference were in tone, rather than content. Key aims around taking the UK out of the jurisdiction of the European Court of Justice, a departure from the EU single market – moving instead towards a “deep and special” trade agreement with the EU that includes financial services – and maintaining the common travel area with Ireland were repeated either in PM May’s statement to the House of Commons, or in the letter to Tusk.

Also confirmed was the UK’s intention to discuss the terms of departure alongside the future deal, aiming to reach agreement on the future relationship by the two-year expiry of the Article 50 process. May’s letter also speaks of implementation periods to avoid cliff-edges as the UK’s current EU membership expires, with “minimizing disruption” seen as an explicit aim.

Overall, today’s announced brought few surprises and saw little lasting market reaction. The UK’s aspiration to discuss the exit terms in parallel with the new agreement has been communicated in the past, but may be at variance with the EU’s preference to take a sequential approach that deals with exit-related issues before discussing a future relationship.

OTC outlook:

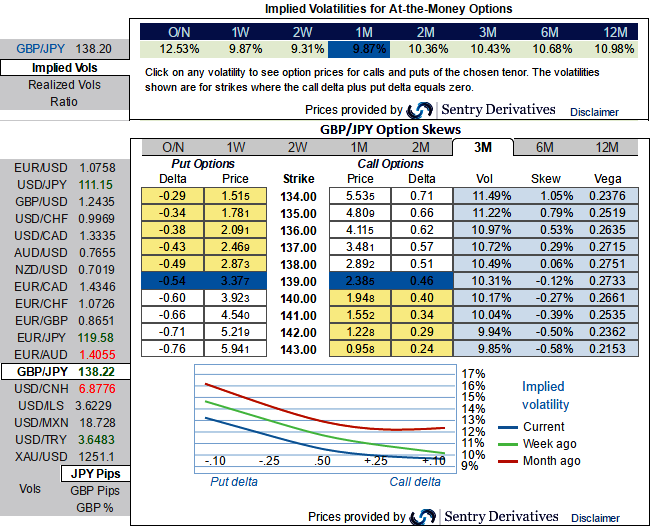

Please be noted that the 2m implied volatilities of GBPJPY are spiking above 10.36%, while positively skewed IVs signifies the hedging interests in OTM put strikes.

In spite of GBPJPY downtrend seems to be intact, a lot of bad news is already priced in and digested by the market. Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit.

GBPJPY lost over 3-4% over this quarter with one fortnight to spare and it doesn’t seem the dust has settled. In the process, volatility fell but remained relatively high on a historical basis.

Assuming a medium-term range in this pair and that negative surprises are no longer market tail risks, the GBP volatility is still a short.

Even if the aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

But further GBPJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would likely to rise significantly as the IVs seem to be favoring these distant strikes. We, therefore, recommend buying a 1m2m IV skews and risk reversal with ATM options.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand