Where does one begin in summarizing the Brexit drama in the six weeks or? The low-vol attrition in the GBP spot rate over this period (NEER down 1.5%) might indicate that the range of developments have been detrimental to the chances of the UK securing an orderly Brexit. That is likely to be the wrong conclusion– in our view, the subjective probabilities of the various Brexit outcomes have actually tilted in a more favorable direction for GBP as a result of the ruling from the European Court of Justice that the UK has the unilateral right to revoke the Article 50 process.

Any which ways, time is running out. Unless the UK takes active measures to prevent the perspective of Brexit deadlock (where UK leaving the EU without a deal), it will leave the EU without a deal on 29th March regardless of Spelman. In the absence of any signs for a postponement of Brexit, which the GBP traders had hoped for, Sterling is trading weaker today. However, compared with previous months Sterling nonetheless remains strong, which seems to be surprising but also could be momentary as you could observe the intensified hedging activities for bearish risks foreseen.

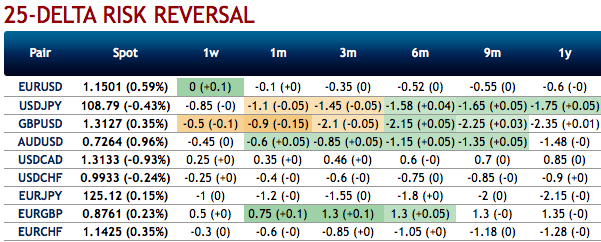

OTC updates:

It is noteworthy from the 1stnutshell that the fresh negative bids for GBP’s crosses have been added.

Please be noted that the positively skewed IVs of GBP pairs signify the hedgers’ interests to bid OTM put strikes up to 138 levels (refer above nutshells evidencing IV skews).

To substantiate the above driving forces of sterling, GBP is factored-in hedging setup to mitigate bearish risks. The negative risk reversals across all tenors also indicate that the downside risks remain intact in the major trend.

GBPJPY display the highest number among entire G10 FX universe (trending between 13.21% - 10.99%).

Hence, vega long put is most likely to perform decently capitalizing on the rising mode of IVs. Courtesy: Sentrix, JPM & Saxobank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -115 (which is bearish), while hourly USD is at -38 (bearish) and JPY spot index was at 76 (bullish) while articulating (at 09:38 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures