Can BoJ deliver ideal monetary policy decision as easing seems stuck in a “catch 22” situation between inflation and yen’s appreciation? The question has been the major focus for the week in economic data releases.

This week is a busy one for Japan data watchers with many June releases including CPI, housing starts, and FX markets digesting the better than forecasted trade balance data, while the key focus should be on Friday’s BoJ policy meeting.

With a clear slowing in the inflation trend and inflation expectations among both corporates and households, and Brexit, we find it hard to imagine whether the BoJ would ease this week or not, given its frequent statement “the central bank would observe risks to economic activity and prices, and take easing measures in terms of three dimensions—quantity, quality, and the interest rate.

If it is judged necessary for achieving the price stability target” (from June Statement on Monetary Policy). The economy has struggled with deflation for two decades. Even after the BOJ's massive qualitative and quantitative easing (QQE) program and venture into negative interest rates territory, the Asian economy hasn't been able to boost domestic consumption and shake off deflation.

Indeed, according to the Japan Center of Economic Research, 86% of 42 economists surveyed between June 27 and July 4 expect policy easing next week. No action by the BoJ would erode its credibility on achieving the inflation target and tighten monetary conditions through JPY appreciation.

The government and the BoJ are less likely to officially admit that they engage in helicopter money policy (BoJ Governor Kuroda has sounded negative about the policy). Nevertheless, the market would see the policy mix of an expansion of fiscal spending and a large amount of JGB buying by the BoJ as a “de facto” helicopter money policy if it happens. And if the “de facto” helicopter money policy accelerates, at some points in the future, Japan’s inflation expectation would start rising considerably, which results in lower real interest rates and depreciation in JPY.

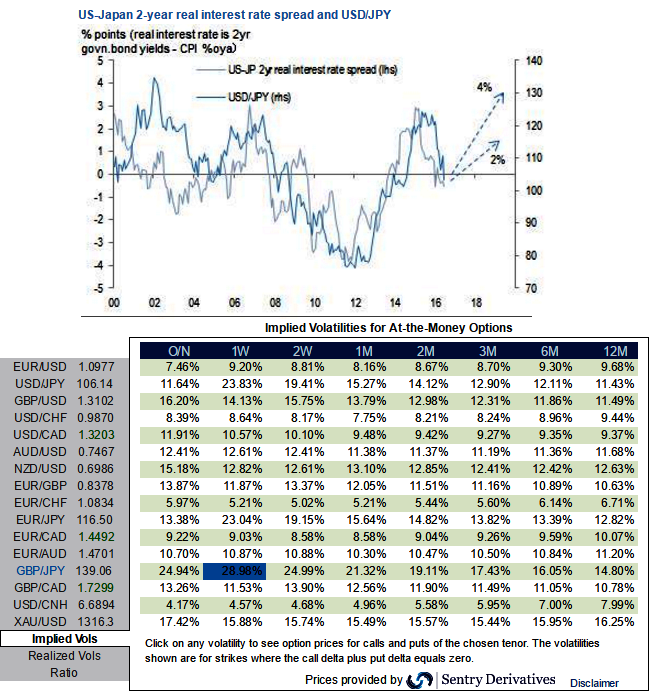

The above chart demonstrates a relationship between US-Japan 2 year real interest rate differential (referring to CPI as a proxy of inflation expectation) and USD/JPY. Based on the past relationship, if Japan’s inflation expectation rises to 2% (4%), USD/JPY would be at 115 (128).

GBP/JPY’s downtrend to prolong after brief upswings – stay short via binaries and futures contracts

The pair has shown whipsaws pattern to the previous brief upswings and rejected the resistances at 141 levels.

The current prices have also drifted below 7DMAs, so major downtrend would likely continue in the long run. While 1w ATM IVs of this pair flashes the highest numbers among G20 currency space, well then it would be smart move to use the brief upswings to deploy bearish hedging strategies along with HY IVs.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell