BoE cites “Brexit uncertainties” cautiously as the Monetary Policy Committee (MPC) of the Bank of England (BoE) decided to keep its main policy rate unchanged at 0.50% held in its monthly policy meeting last week. The MPC furthermore decided to uphold the bulk of its asset purchase as well (i.e., QE) program at £375 billion.

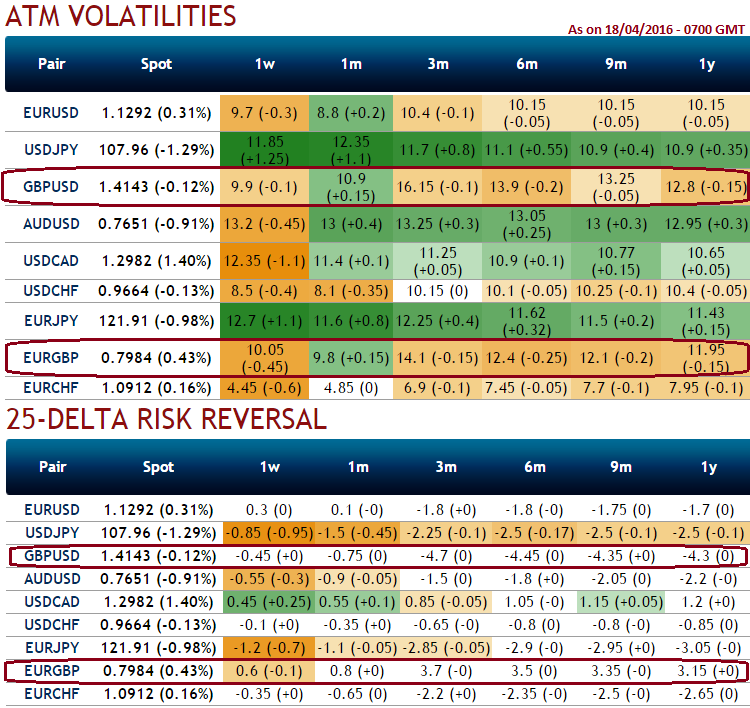

Both decisions were unanimous and both decisions were widely expected. The MPC hinted that policy likely will remain unchanged in the near term. As a result, the likelihood of the significant 'brexit' will likely keep pressure on the UK currency through the foreseeable future, while this fairly anticipated rates have forced short-term volatility to shrink away (see IV nutshell for GBPUSD & EURGBP’s reduced IVs in 1W expiries and spiking crazily for 3M tenors).

The MPC has explicitly mentioned the uncertainties surrounding the impending referendum on U.K’s membership in the European Union that will be scheduled on June 23rd.

The policy statement also revealed that there are some signs that capital expenditures and commercial property transactions were being postponed to await the outcome of the referendum.

Moreover, the MPC believes that data could become increasingly volatile and difficult to interpret as the referendum draws closer. In short, the Bank of England clearly will not be hiking rates between now and June, at the earliest.

Could the MPC cut its main policy rate and/or increase the size of its QE program? Sure. Although we would not necessarily rule out further policy accommodation in the event that voters decide to remain in the EU, we think the bar for further easing would be higher under that scenario than under a scenario in which “Brexit” occurs.

If Brexit does not happen, the MPC would be most likely to hike rates in early 2017. A decision to depart the European Union would cause uncertainties about the near-term outlook for the British economy to spike, in our stance, and likely would lead to further easing by the MPC shortly after the referendum.

As the risk reversals for 1M – 3M expiries of GBPUSD also indicate that the puts have been relatively expensive and as stated above traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.