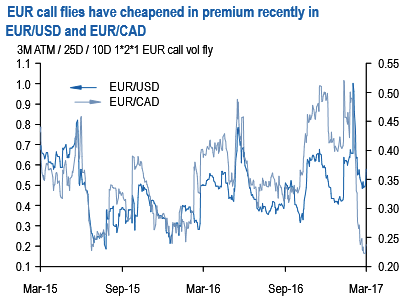

Along similar lines of EURUSD, we also like EUR call/CAD put flies.

The macro view on CAD is negative on a mix of BoC dovishness, sensitivity to NAFTA renegotiation talk which is likely to re-enter headlines over the next few weeks, and the potential for further near-term slippage in oil prices.

We introduce a Bank of Canada rate hike forecast for 3Q18 but would need to see a shift in tone to move it forward

Despite a strong run of Canadian data, the Bank of Canada has retained a dovish tone in its communications in recent months. This week continued that pattern, with Governor Poloz reiterating his belief that the Canadian output gap remains large, but January GDP subsequently surprised strongly to the upside. Our nowcaster now looks for 4.8% SAAR GDP growth in 1Q; we raise our forecast to a more cautious--but still robust--3.8%.

Hence, option pricing heavily favors EUR call/CAD put fly ownership, which are near 3y lows in premium (refer above chart).

2M 1.46 – 1.49 with 1.52 RKI –1.52 EUR call/CAD put flies indicatively cost at 35 bp EUR (spot ref. 1.4260, max payout ratio 5.8 times if RKI triggered, 11.4 times if not).

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields