Although the projections of pullback in USD/CAD as the year progresses upon an expected stabilization then rebound in crude oil prices and better performance in the non-resource sector, Q1 would still favor prevailing bull run.

The benefits of a weaker CAD are expected to present a boost to growth via exports and there are signs that the most exchange rate sensitive sectors are already performing well.

When the BoC caught up with its inevitably unforeseen interest rate cut in January in restoration to the oil price crash, markets and experts quickly posted queries Governor Stephen Poloz's credibility and wisdom.

We look ahead for the BoC to commence tapering monetary policy in Q4 2016, contributing to a pullback that takes USD/CAD to 1.33 at year end.

We have not incorporated fiscal stimulus into our forecasts as we have not had the Budget yet but this should be an upside risk to our 2.2% growth forecast.

We stress that the lack of a recovery in crude oil prices remains the most important risk to our CAD outlook.

This would likely establish new stage for USD/CAD bulls run in Q1 of 2016.

But for now the trade idea is to add fresh longs on USD/CAD on every dips. Eyeing on such dips for better entry levels again by raising the stop for now to 1.38004 for targets around 1.3952, 1.40 junctions in end of Q1. Our initial take profit remains 1.3750, at which point we will reassess.

So for now it is wise to deploy following strategy and keep your forex portfolio rest assured with riskfree solution.

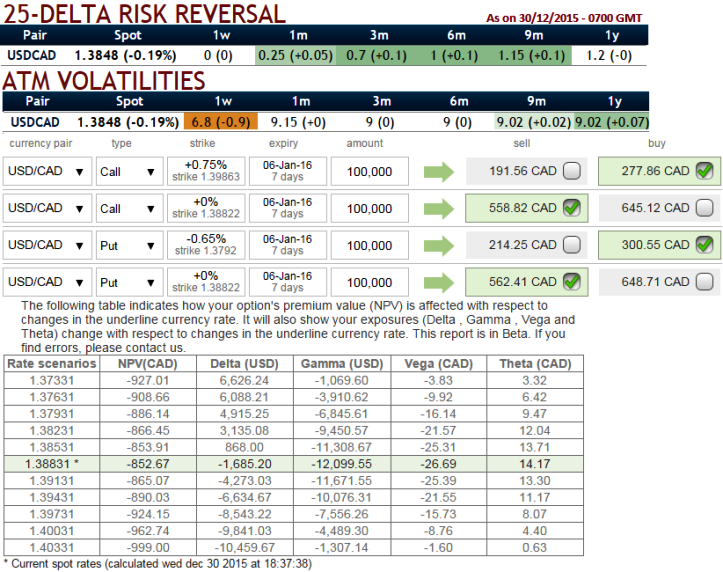

Long 1w (0.65%) OTM 0.30 gamma put (strike at around 1.3770) & Short 2D ATM Put + Short 2D ATM Call & Long 1w (0.75%) OTM 0.27 delta call (strike at around 1.3966).

Gamma on Long OTM call was at 27.97, while gamma on long OTM put was at 30 that cushions downside risks comparatively.

We've constructed this option combination by considering reasonable gamma that would factors in the spot market sentiments and OTC risk reversal on option price because gamma represents the change in delta. As shown in the diagram, the strategy could be considered upon retrospective assessments of vols and risk reversals.

FxWirePro: BoC’s all efforts count on time, CAD to extend its loses against dollar – stay long in dollar via gamma iron butterfly combos

Wednesday, December 30, 2015 1:11 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand