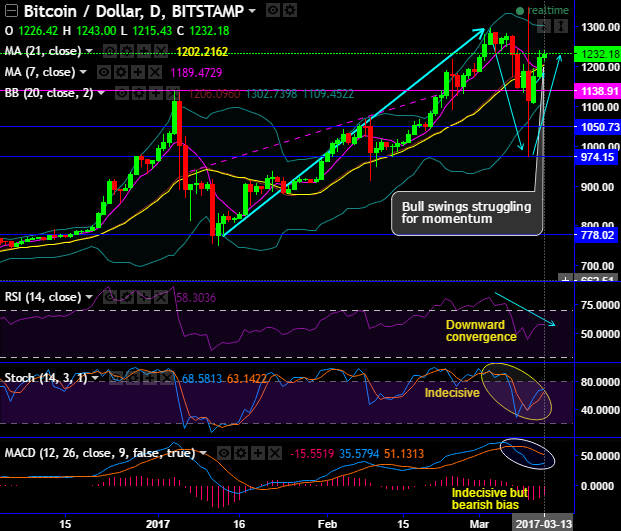

After strong support at $975 (7EMA), BTCUSD has bounced back above DMAs to the current 1232 levels, while the leading oscillators have reached overbought zone (see monthly chart) and a decisive sustenance above DMAs would likely drag rallies swiftly up to the recent highs of 1275 and even 1350. Bitcoin has considerably spiked over 100% in the last week rising from $975.10.

For almost four years the Winklevoss twins have had to deal with bureaucrats, addressing their every concern, setting up their own exchange and going through the trouble of getting a Bitlicense, setting up an auction to carry out ETF business, but that apparently wasn’t sufficient – the SEC wants “surveillance.”

The SEC stated, "the Commission is disapproving this proposed rule change because it does not find the proposal to be consistent with Section 6(b)(5) of the Exchange Act, which requires, among other things, that the rules of a national securities exchange be designed to prevent fraudulent and manipulative acts and practices and to protect investors and the public interest."

Fundamentally, in the recent times, the digital currency was under the scanner of SEC (securities Exchange Commission) for the approvals of ETF trading. The astounding SEC decision, at the last hour, of the very last day, on a Friday afternoon, is way over budget and could not be any more behind schedule.

The US Securities and Exchange commission on last weekend declined of a request to list what would have been the first U.S. exchange-traded fund built to track bitcoin, the digital currency.

On a broader perspective, the major uptrend seems to be intact as the both RSI indicates strength in the robust uptrend despite short-term hiccups, while and stochastic signals overbought pressure that is threatening for healthy bullish momentum.

If bulls manage to maintain above 7DMA levels, then it would shoot up to the recent highs of 1275 levels. MACD also substantiate this bullish stance.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary