The FX Markets began pricing in owing to a Trump’s victory after the Republican candidate took the lead over the democrat. The U.S. dollar managed to bounce back vigorously after the US Election Day from the slumps of 101.190 to the current 106.140 levels during mid-European sessions.

The election of Donald Trump as the next US president saw the initial “risk-off” move properly trumped, as his acceptance speech was more conciliatory and the focus moved towards his fiscal policies. US equities, particularly the S&P500, flew back towards all-time highs, while the US yield curve steepened, led by 10-year yields racing up through 2%. This lent renewed support to the USD, especially versus G10.

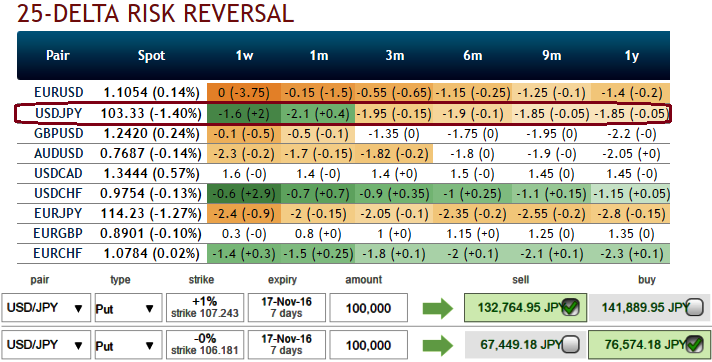

USDJPY risk-reversals: USDJPY risk-reversals are still very much a work in progress as far as vol selling opportunities go, with current levels (3M 25D risk reversals at 1.8 vols for USD puts over USD calls) still removed from post-Brexit extremes (2.8), 1m IV skews to substantiate this signal offered by risk reversals. But short-term risks reversal bets signals the higher potential of USD.

If we do get close to those levels however, selling yen riskies should be highly attractive since the BoJ's yield curve control policy is proving more successful in capping JGB yields and suppressing yen vol than we had initially imagined, and a widening US-Japan yield gap as the Fed cycle resumes could conceivably even push USDJPY gradually higher towards the 105-107 area.

Needless to say, selling expensive yen calls should prove profitable amid such a mild updraft in USDJPY spot.

Hence, contemplating above risk reversal adjustments, we foresee the opportunities in writing overpriced ITM puts coupled with adding long positions in ATM delta puts long-term tenors.

As shown in the diagram, one can add 2w (1%) ITM shorts while going long in ATM -0.49 delta puts with preferably longer tenors comparing to the short leg. Please be noted that the tenors chosen in the diagram are just for the demonstration purpose only, use narrow expiries on the short side.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch