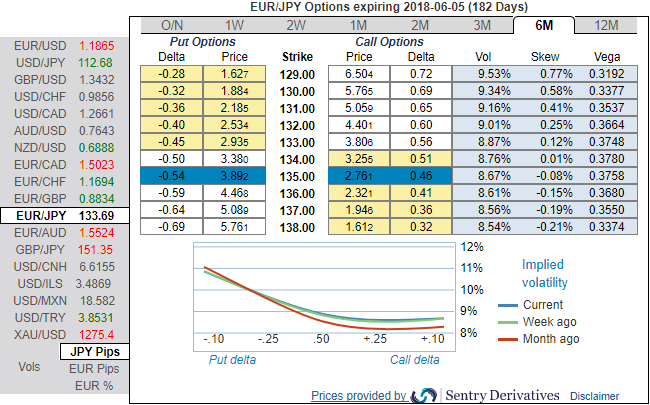

Please be noted that the bearish neutral risk reversals are still indicating bearish risks in longer tenors, while positively skewed IVs of the 6m tenor signifies the hedgers’ interests in OTM put strikes. These skews signal underlying spot FX to drop below 129 levels.

To substantiate this standpoint, if you observe the technical chart of this pair, the major trend has been rising higher above 50% fibos from the lows of 109.205 levels but restrained below 61.8%. The technical momentum indicators have also been substantiating overbought pressures in this consolidation phase (refer monthly chart). For more reading, refer our technical section.

Hence, keeping the both OTC and technical factors in mind, it is advisable to initiate below relative value trades.

Sell 6M EURJPY 25D risk-reversal (buy EUR calls - sell EUR puts), delta-hedged for risk-averse traders.

Buy 3M EUR puts/JPY calls vs. sell 3M 28D EUR puts/KRW calls for directional traders.

Buy 3m EURJPY ATM -0.49 delta puts for aggressive bears on hedging grounds.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 47 levels (which is bullish), while hourly JPY spot index was at shy above -133 (highly bearish) while articulating (at 07:23 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation