The bull trend of this pair remains intact despite the divergence between various central banks, only that has developed the turbulence in among the speculator. Otherwise, FX being way out of line with rate spreads. We have no other worrying technical signs at this moment in time, instead, technicals have been indicating the robust bullish trend. So, a price break-out through a crucial resistance level of 1.4984 is needed to give another sound warning sign of a broader uptrend, and it seems most likely.

OTC outlook and Options Strategy:

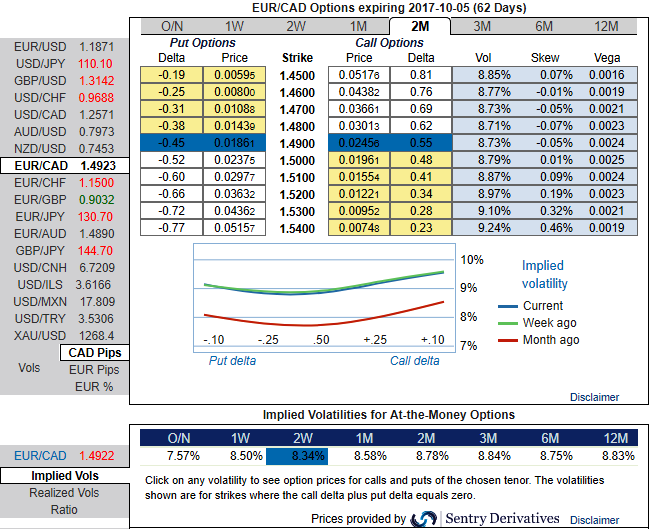

Please be noted that from spot rates, the 2w IVs are trending at 8.31% and 8.78% for 2m tenors.

While positively skewed IVs of 2m tenors signify the hedgers’ tendency for bearish risks as they bid for OTM put strikes and IVs are just shy above 8.75% which is on higher side comparatively, it is a good news for put holders.

This implies hedging sentiments for the bearish risks in the underlying spot. Hence, put option holders would be on upper hand of these tenors.

You couldn’t see any drastic spike upto next 2w tenors despite crucial news are lined for the Canadian side. Canadian unemployment claims and trade balance are lined up announcements.

At spot ref: 1.4910 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. For the bullish streaks that we are inclined while not disregarding to position a partial retracement of the down move in near terms through call ratio back spreads (CRBS) with narrowed expiries, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Alternatively, using any abrupt dips writing any overpriced OTM calls is a wise idea on hedging grounds. Thus, you decide to initiate a diagonal call ratio back spread (CRBS) at net debit.

Execute strategy this way, to arrest both short term dips and long term bullish risks, initiate shorts in 2W (1%) out the money call with positive theta, simultaneously, buy 2 lots of 2M (1%) in the money 0.67 delta call option. Establish this option strategy if you expect that EURCAD would expect vigorous spikes during next 2 months tenor amid minor hic-ups in short run but spikes certainly not beyond your upper strikes.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand