We see AUDUSD, in short run, to extend further consolidation phase between 0.7850 and 0.8000.

Medium term perspectives: Much of AUDUSD's gains have been driven by broad US dollar weakness. But there has also been a partial recovery in Australia's key commodity prices, after very steep declines in April and May.

However, beyond multi-week gains, a firmly on hold RBA is likely to keep a lid on AUDUSD, easing to 0.74 by year-end.

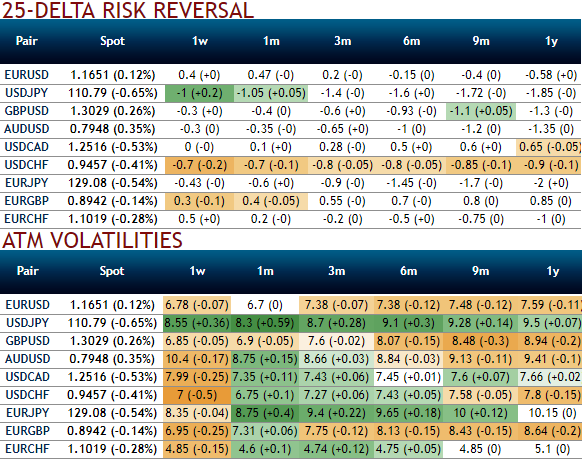

AUDUSD's rising IV in 1m and shrinking in 1w tenors with bearish neutral delta risk reversal can be interpreted as opportunity for put longs in long term and theta shorts in short run as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

Please be noted that the positively skewed IVs of 3m tenors also signify the hedgers’ interests to bid OTM put strikes upto 0.77 levels (refer above diagram).

While delta risk reversal reveals divulge more interests in hedging activities for downside risks even though we see the neutral shift in this bearish hedging arrangements.

So, the speculators and hedgers for bearish risks are advised to capitalize on the prevailing rallies and bid on 1-6m risks reversals to optimally utilize vega longs.

We advocate weighing up above aspects and uphold the same option strategy on hedging grounds, we eye on loading up with fresh vega longs for long term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 2 lots of Vega long in 1m ATM -0.49 delta put options.

OTM options would be the cheapest but they rely solely on extrinsic value and have a low Delta, Theta, and Vega. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium. However, Theta (time decay) also increases especially as expiry approaches. Hence, OTM shorts in calls in such scenario are most suitable for speculation.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?