Please be noted that the IVs of RUB are the highest among G20 currency space. The volatility parameters favor structures that sell topside skew to cheapen up bullish USDRUB exposure. Being long USDRUB is a good hedge for a portfolio with high yielder exposure.

Are you concerned that RUB positioning is too heavy? We are. The stagnant price action is a warning sign, fundamentals could turn, and a significant correction could happen? On 31 May, we recommended going long USDRUB as the ruble had approached the tipping point, looking for a move to 61.30 in the next three months, based on domestic factors. We have a constructive view on EM assets, and our portfolio of trade recommendations is long FX carry trades (ZAR, MXN and TRY).

However, our exposure has been selective, and we have shied away from short dollar risk in the BRL and RUB in recent months. Being long USDRUB is a good hedge for a portfolio with high yielder exposure.

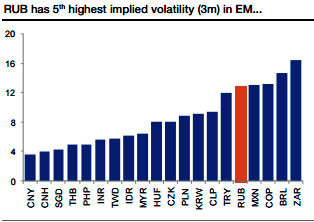

Negative carry is quite punitive in forwards (-75bp/month), so cost-effective option exposure is a good alternative. Shorting the RUB in volatility space is also very expensive: implied vol is one of the highest in EM and risk reversals are the highest. The skew-to-ATM volatility ratio has been rising steadily since early 2016, likely related to investors hedging bullish RUB price action. These volatility parameters favor structures that sell topside skew to cheapen up bullish USDRUB exposure.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close