It is observed that the Japanese retail investors likely to surge foreign stock investments through investment trusts especially between May and July as we saw in the past two years. It is also expected that the USDJPY to rebound in 2Q a bit.

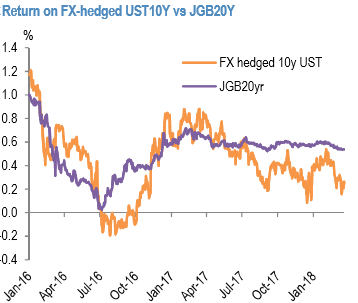

While the U.S. short-term interest rates have risen sharply, meaning that returns on FX-hedged U.S. bond investments are falling (refer 1st chart).

The US 10yr treasury yield rose from 2.77% to 2.84%, 2yr yields from 2.30% to 2.35%. Fed fund futures yields firmed to price the next rate hike in June as a 90% chance.

Given that U.S. long-term rates are relatively high and that the USDJPY rate is currently below the lower end of the CY’2017 range, life insurers could reduce the FX hedge ratio on U.S. bond holdings and a greater portion of their new overseas bond investing could be un-hedged. It would cause JPY sales.

Life insurers currently own a total of around ¥85 trillion in overseas bonds, and we estimate the ratio of FX-hedged overseas bonds to be around 70%.

Since reducing the ratio of FX-hedged bonds by 1% means selling over ¥800 billion worth of JPY, the impact cannot be ignored.

Separately, although returns on FX-hedged U.S. bond investments are diminishing, the returns on FX-hedged European bonds are relatively high (refer 2nd chart). While this would have no impact on the JPY market, we think FX hedged overseas bond investing by Japanese investors will probably shift away from U.S. bonds and toward European bonds.

Over the four months spanning October 2017 to January 2018, domestic investors were net sellers of U.S. bonds by ¥4.5 trillion and net buyers of European bonds by ¥2.8 trillion.

It seemed that in the recent times as if USDJPY was displaying exchange rate moves that correlated with the risk-on/-off news flow. But as soon as one takes a look at exchange rate moves of the second typical safe-haven currency, the Swiss franc, this does not really work. I fear the correlation structure of the exchange rates cannot be explained with simple, mono-causal stories such as risk-on/risk-off at present. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell