Poor visibility on US-China talks and an extended period of disappointing data keep us defensive, even though some metrics of global growth momentum have stabilized. PMIs and trade talks will be key in the coming weeks.

Defensive exposure is increased this week, motivated by idiosyncratic factors relating to AUD and NOK.

RBA is scheduled for the next week for their monetary policy meeting, the Aussie central bank turned more dovish. Increase AUD shorts via bearish AUDJPY put spread, partly financed by selling AUDNZD topside.

We have made some minor changes to our year ahead AUDUSD forecasts and see AUD at USD0.67 in the near term (prior was USD0.66) and at 0.65 by Jun- 20 (unchanged). The main drivers of AUD over the next year are still familiar; a global economy which grows at trend at best, Fed easing, our expectation of further easing from the RBA in 1H’20 and still significant domestic economic headwinds. But the prospect of additional easing from the Fed before year-end, while the RBA pauses could limit the downside for the currency near term.

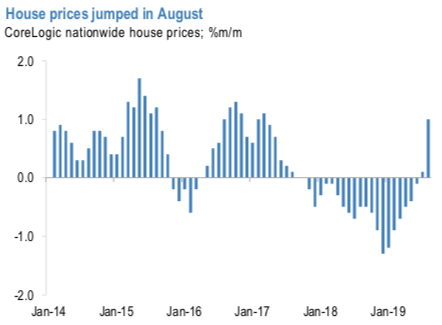

The RBA has signaled a desire to watch incoming dataflow, after easing 50bp earlier this year. Recent communication from the Bank has added a conditionality to the further easing and noted that an “accumulation of evidence” will be required before the Bank considers the need for further rate cuts. We view this as consistent with our view that the RBA is on hold for the remainder of the year, and recent housing numbers (loan growth and house prices – refer above chart) and the labour market data lend support to this view.

In addition, our current forecast sees a better outlook for global growth in 1H’20 vs. 2H’20 (average quarterly SAAR rates of 2.30% vs. 2.65%), so fears around global recession could dissipate into year-end if activity data show signs of stabilization and improvement. If realized, this could also help AUD consolidate for the next couple of months. In the medium term, however, we still expect AUD to resume its decline towards USD0.65 as ongoing question marks about the resilience of global growth and the trajectory of the domestic economy underpin a less optimistic outlook for AUD.

Trade tips:

Buy a 3m AUD/JPY put spread (72.0/69.5) (spot ref: 73.2); sell a 3m 1.0975 AUD/NZD call (spot ref: 1.0820). Paid 0.38%.

In yet another trading perspective, at spot reference of AUDUSD: 0.6752 levels, bidding bearish rationale, it is advisable to execute tunnel spread options strategy with upper strikes at 0.6780 and lower strikes at 0.6705 levels, thereby, one can fetch certain yields as long as the underlying spot FX keeps dipping but remains above lower strikes on the expiration.

Alternatively, on hedging grounds ahead of RBA’s monetary policy that is scheduled for the next week, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.66 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise