The Bank of Japan (BoJ) is scheduled to hold a 2-day monetary policy meeting on March 15-16 and is set to announce its decision on Thursday. BOJ would want to see a clear uptrend in consumer prices and importantly, an establishment of the demand-side inflation dynamics, before starting to withdraw stimulus. Hence we expect the BoJ to keep monetary policy steady on Thursday.

While GDP growth has reverted to 1 percent on rising exports, inflation and inflation expectations have remained sluggish. Headline CPI was slightly positive at 0.5 percent in January, and core CPI less food and energy was about zero. BOJ targets 2 percent inflation which has never been achieved during the past two decades (except during the 2014 sales tax hike).

"The conclusion of the BoJ's Policy Board meeting on Thursday will see its Yield Curve Control framework left unchanged, while members will maintain an upbeat view of the economic outlook," said Daiwa Capital Markets in a research note.

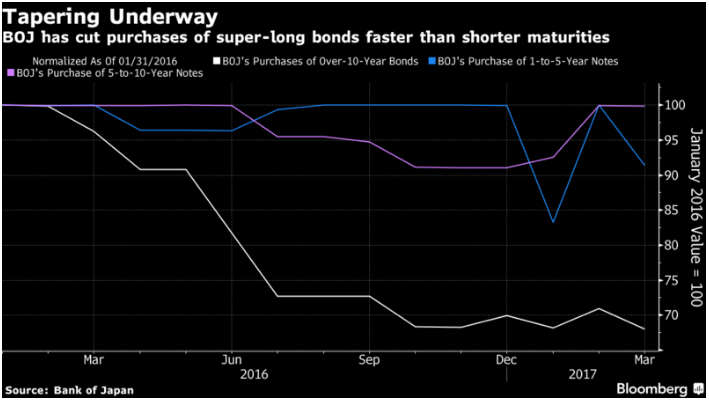

The central bank is expected to maintain its short-term interest rate target at minus 0.1 percent and a pledge to guide the 10-year government bond yield around zero percent via aggressive asset purchases. Analysts also expect the BoJ to keep intact a loose pledge to maintain the pace of its annual increase in Japanese government bond (JGBs), which is JPY80 trillion (USD696.62 billion).

“Given the BOJ is committed to managing the yield curve, any upward pressure on yields could lead to an increase in bond purchases in the future,” said Yusuke Ikawa, Japan strategist at BNP Paribas SA in Tokyo. “If it maintains its zero percent target, the BOJ faces the risk of one day having to buy more than 80 trillion yen of bonds a year.”

Holding onto both the targets for quantitative easing and yield-curve control will prove to be a challenging task for the BoJ. The central bank may be forced to raise its yield targets to avoid ramping up bond purchases if Japanese long-term interest rates track global bond yield rises, which are being driven by expectations of higher US interest rates.

While the BOJ board is projected to keep policy unchanged at its March 15-16 meeting, a shift to a range for the 10-year yield target may come under consideration at some point, Bloomberg reports sources close to the central bank as saying.

USD/JPY was trading at 114.84 at around 1220 GMT. FxWirePro's Hourly JPY Spot Index was at -15.5358 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand