Dear readers, please be noted what has happened with our recent write up before we rush up into derivatives strategy,

Please follow the below link:

http://www.econotimes.com/FxWirePro-GBP-AUD-supported-at-channel-line-%E2%80%93-targets-70-80-pips-northwards-137904

Well..., after going through above article and compare the prevailing price on plotting of daily charts you may now be able to cope up with the perplexity of these puzzling swings, cheers on this.. yes, one would have been assured with recent upswings were exhausted as a resultant effects of channel resistance. So it has taken a resistance exactly at 2.0979 (highs of 11th Jan).

For now, in our opinion as it has tested weakness at channel resistance, the prices to drop back towards channel supports.

On UK side the recent fundamentals were also lackluster, following a sharp decline in the housing construction sub-index in November to 55.3, we also noticed manufacturing production has slipped to -0.4% to miss the 0.1% forecasts the December series to overturn much of that loss, lifting the overall index to 56.1. On the flip side, Aussie unemployment remained unchanged at 5.8% below forecasts at 5.9%.

Having said that, we can vouch so audaciously for sure that these technical fundamental hints would give us the hints on trend directions of this pair.

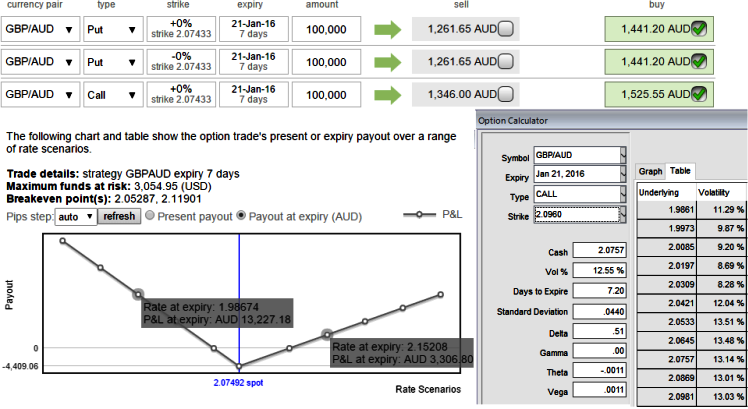

Hedging Perspectives: Option Strips (GBPAUD)

Subsequently, those who deployed straps strategy last week, FX bullish swings would have derived assured returns (strategy fetched you handsome yields through ATM calls when the pair began spiking from 2.0393 to 2.0979) and for now the recommendation goes this way, go long in 2 lots of 10D -0.49 delta ATM puts and there onwards 1 lot of 0.50 delta ATM puts of same expiries.

Thereby, ongoing declining trend and any abrupt upswings would be taken care by delta adding leveraging touch to the portfolio.

For now, the pair has pretty much responded as per earlier our bearish anticipation and no hesitation in foreseeing price bounces later on again with least risky scenarios that would result in some price recoveries.

One can also observe the rising delta effects upon rising exchange rate GBPAUD and shrinking as the underlying spot rate dips which means our underlying outrights are fairly hedged against irrespective of rate scenarios.

Delta of far OTM options is very small which is why we've chosen ATM instrument on call. 1-point movement in underling pair will not have much effect on the option premium.

FxWirePro: Back testing of last week’s GBP/AUD straps strategy keeps us loading up weights in ATM puts on strips for speculations

Thursday, January 14, 2016 10:19 AM UTC

Editor's Picks

- Market Data

Most Popular