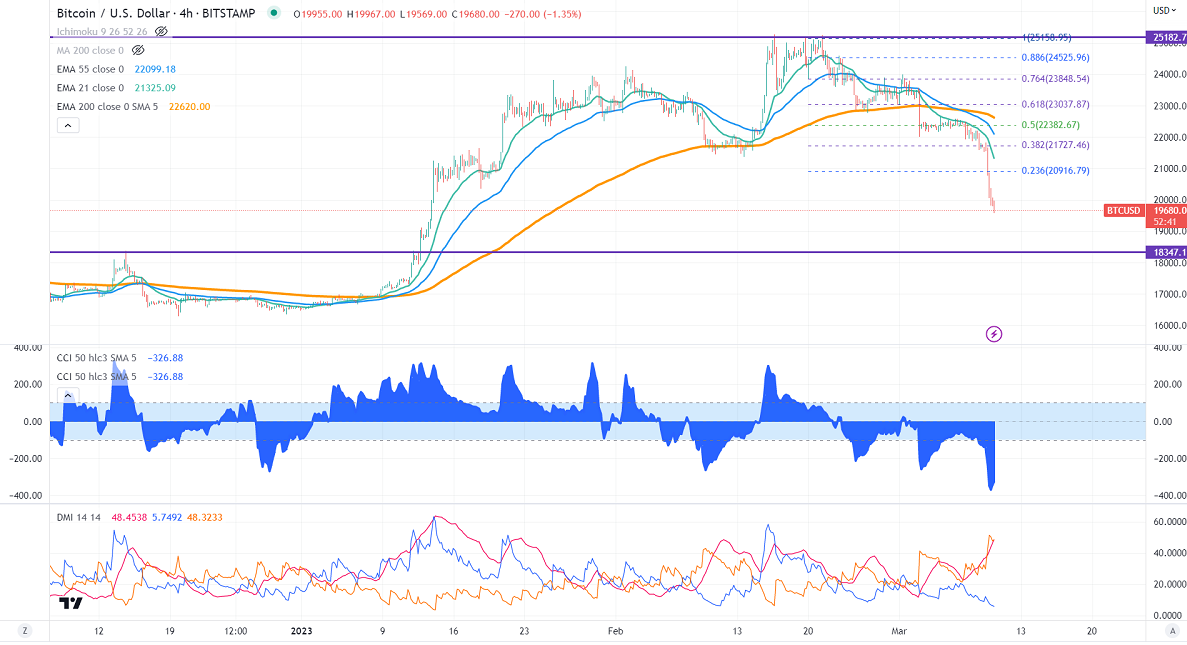

BTCUSD price witnessed a steeper correction on weak market sentiment. The chance of aggressive rate hikes by the Fed and ECB has decreased the demand for riskier assets like stocks, Crypto. Markets eye US Nonfarm payroll jobs data for further direction. The liquidation of $303 million worth of positions as fear of crash intensifies. BTC hits a low of $19569 and currently trading around $19655.

The number of people who have filed for unemployment benefits rose to 211K for the week ended Mar 14th, compared to a forecast of 195K.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC)- Bearish (negative for BTC). The index lost more than 2% yesterday due to the Silicon valley bank crisis. Any weekly close below 12000 will push NASDAQ prices lower to 11350.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Mar declined to 63.1 from 78.6% a day ago.

Technicals-

Major support- $19300. Any break below will take to the next level at $18000/$17000 if possible.

Bull case-

Primary supply zone -$20700. The breach above confirms minor bullishness. A jump to the next level of $21490/$22000/$23990/$25300 is possible. Bearish invalidation only if it breaks $25300.

Secondary barrier- $25300. A close above that barrier targets $30000/$37000/$4000.

It is good to sell on rallies around $20000 with SL around $21000 for TP of $17000.