BTCUSD is trading flat ahead of the US FOMC monetary policy. Any hawkish rate pause will put pressure on crypto markets. It hit a low of $60760 and is currently trading around $63227.

Bitcoin purchases in Argentine largest exchange, Lemon surged to 34700 -the highest weekly volume in 20 months, According to Bloomberg.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (negative correlation with BTC) - Bullish (neutral for BTC). The NASDAQ is showed a minor pullback ahead of Fed policy. Any close above 18350 will take the index to 18500.

According to the CME Fed watch tool, the probability of a no-rate cut in Mar decreased to 99% from 98% a week ago.

Technicals-

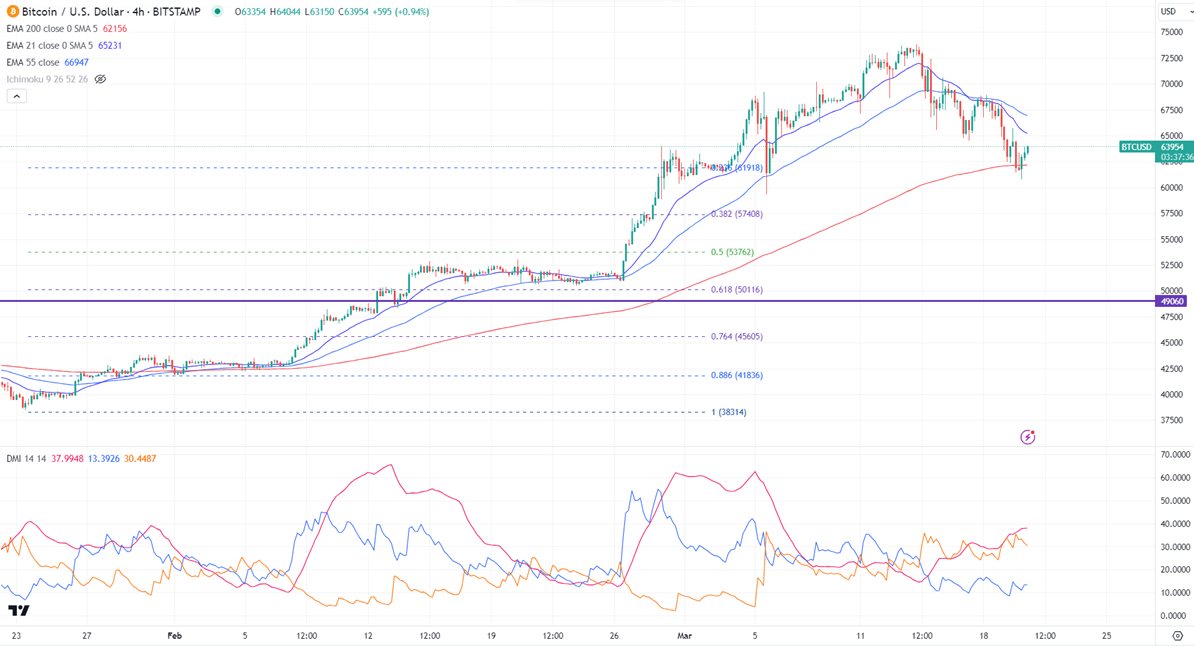

BTCUSD trades below the short-term moving average (21 and 55 EMA) and above the long-term moving average (200 EMA) in the 4-hour chart.

Minor support- $61900. Any break below will take it to the next level at $60000/$59000.

Bull case-

Primary supply zone -$65000. Any break above confirms a bullish continuation. A jump to$69000/$75000 is possible.

Secondary barrier- $75000. A close above that barrier targets $80000.

It is good to buy on dips around $59000 with SL around $56000 for TP of $75000.