BTCUSD pared some of its gains after hawkish FOMOC meeting minutes.BTC hits a low of $28300 and currently trading around $28507.

US FOMC meeting minutes indicate that the central bank to hike rates by another 25 bpbs this year to tackle inflation.

Major economic data for the day

Aug 17th, 2023, US Unemployment claims (12:30 pm GMT)

Philly Fed manufacturing index

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC) - Bearish (neutral for BTC). The correlation between Bitcoin and NASDAQ diverged and 90 -the day correlation dropped to almost zero. Any decline below 14800 will take the index to 14500.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep decreased to 86.5% from 89% a week ago.

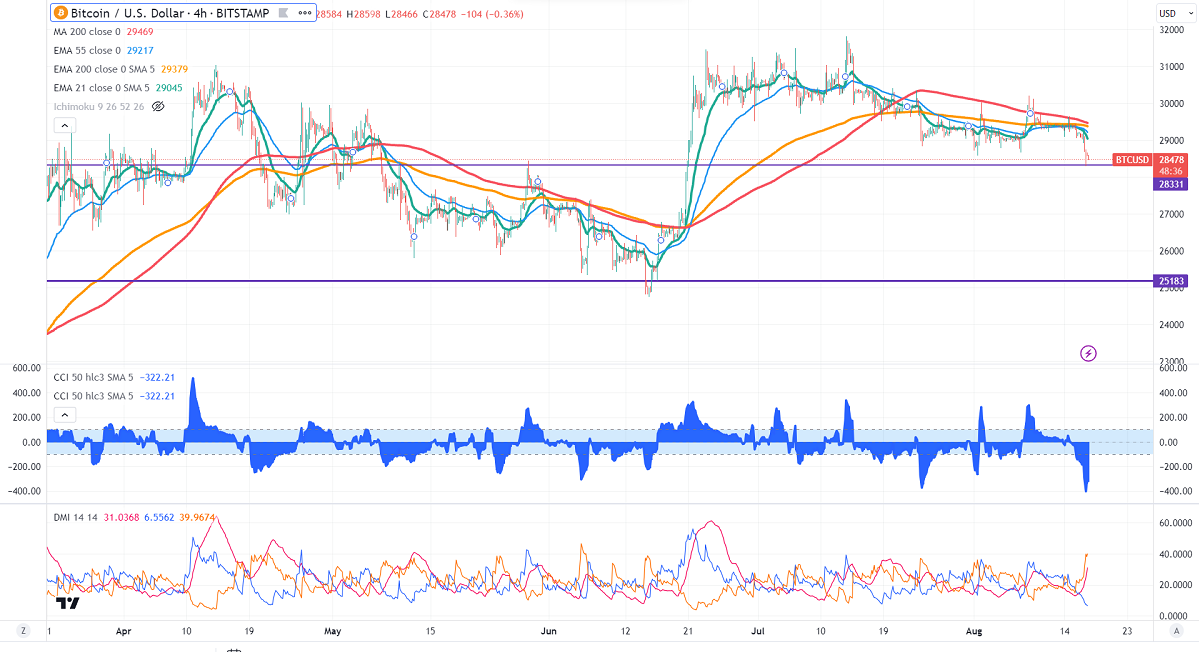

Technicals-

Major support- $27500. Any break below will take it to the next level at $25000/$23800/$23300 if possible.

Bull case-

Primary supply zone -$32000. The breach above confirms minor bullishness. A jump to the next level of $36300/$40300/$41349 is possible.

Secondary barrier- $42600. A close above that barrier targets $48800/$50000.

It is good to buy on dips around $27500-600 with SL around $24500 for TP of $35000/$40000.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary