BTCUSD lost its shine after US Fed's hawkish rate pause. Fed kept its rates unchanged at 5-5.25%. The central bank has projected the median federal funds rate from 5.1% to 5.6% (three more 25 bpbs rate hikes in 2023). For 2024 it increased from 4.3% to 4.6%.SEC action against Binance and Coinbase law violations. BTC hits an intraday low of $24813 and currently trading around $24881.

Major economic data for the week

Jun 15th, ECB monetary policy (12:15 PM GMT)

US Core retail sales m/m and Empire State Manufacturing Index (12:30 PM GMT)

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC) - Bullish (neutral for BTC). The correlation between Bitcoin and NASDAQ diverged and 40 -the day correlation dropped to 0.19. Any weekly close above 15000 will take the index to 15300/15500.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 71.9% from 50.9% a week ago.

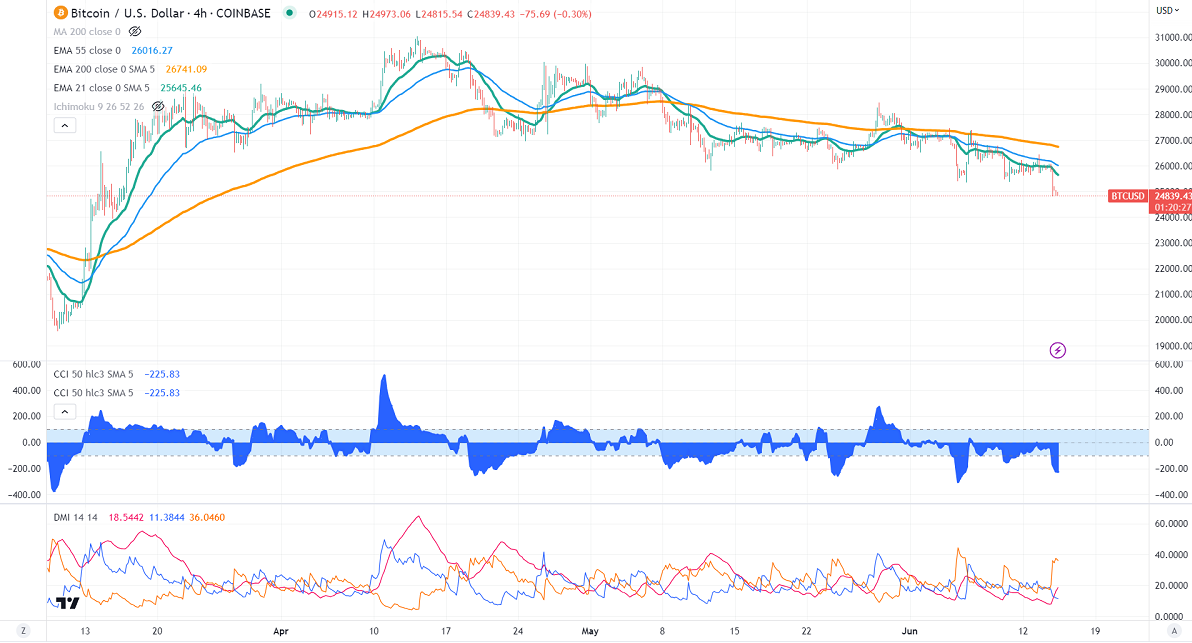

Technicals-

Significant support- $24800. Any break below will take it to the next level at $23800/$23300 if possible.

Bull case-

Primary supply zone -$26300. The breach above confirms minor bullishness. A jump to the next level of $ 28500/$30000 is possible.

Secondary barrier- $30000. A close above that barrier targets $37000/$43500.

It is good to buy on dips around $23800 with SL around $20000 for TP of $34000.