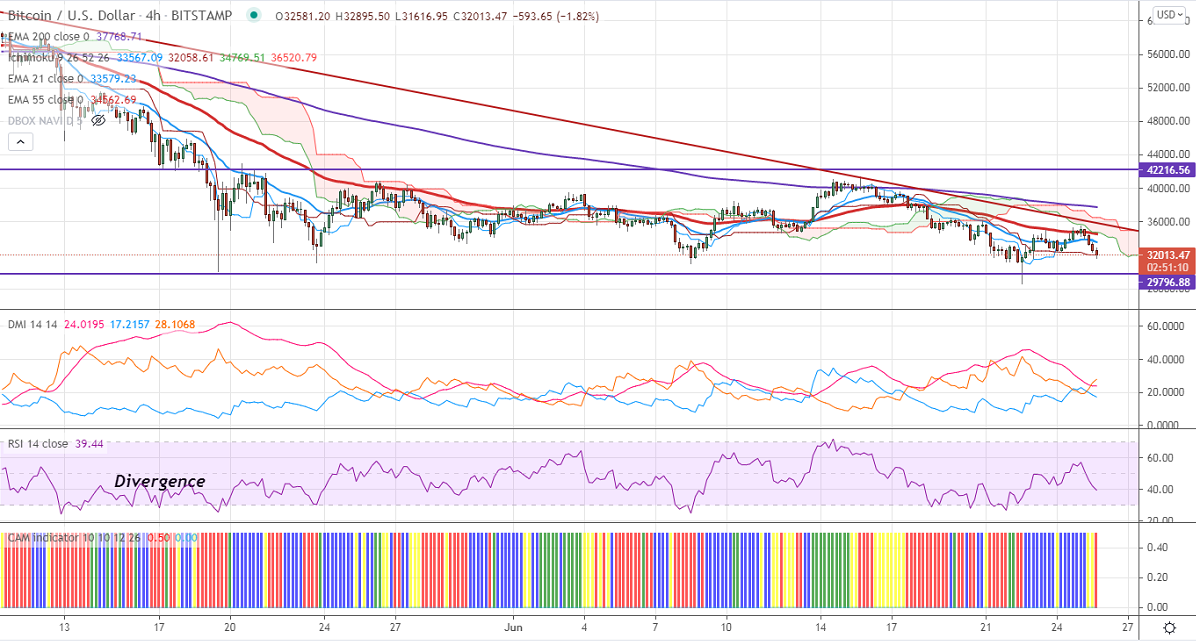

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $34970

Kijun-Sen- $34970

BTCUSD has declined once again after a minor pullback to $35517. Lots of miners are moving out of china as strict action taken by Chinese authorities. The pair was one of the worst performers for the past two weeks and lost more than 25%. The short-term trend is still bearish as long as resistance $43000 holds. It hits an intraday low of $31616 and is currently trading around $32058.

The near-term resistance is around $35600. Any indicative break above targets $38097.Minor bullish continuation above $41500.

The pair's minor support is around $32000. Any convincing break below will drag the pair down to $30000/$28500/$26800/$24651 (161.8% fib)/$22450.

Indicator (4-Hour chart)

CAM Indicator – Bearish

Directional movement index – Bearish

It is good to stay away.