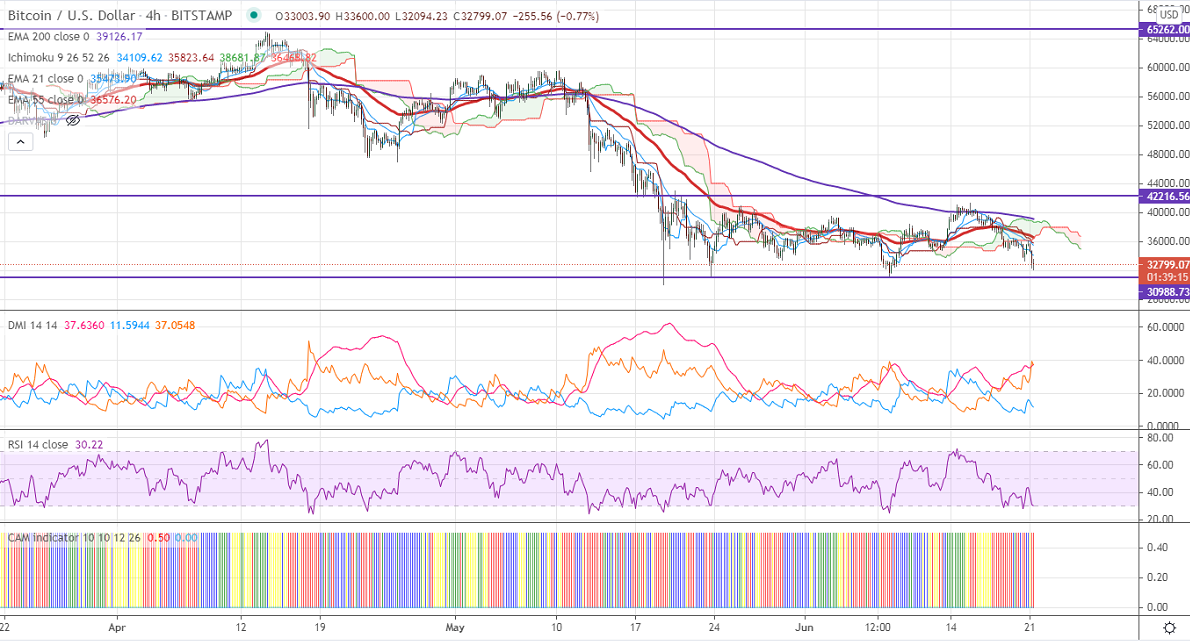

Ichimoku analysis (4-hour chart)

Tenken-Sen- $36882

Kijun-Sen- $36183

BTCUSD continues to trade lower and lost more than 20% in the past two days on china's mining crackdown. The Chinese authorities have asked to close cryptocurrency mining projects in the southwest province of Sichuan. The short-term trend is still bearish as long as resistance $43000 holds. It hits an intraday low of $32094 and is currently trading around $32921.

The near-term resistance is around $34250. Any indicative break above targets $36600/$37800/$41350. Minor bullish continuation above $41500.

The pair's minor support is around $3000. Any convincing break below will drag the pair down to $26800/$24651 (161.8% fib).

Indicator (4-hour chart)

CAM Indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $33800-4000 with SL around $36500 for TP of $26800.