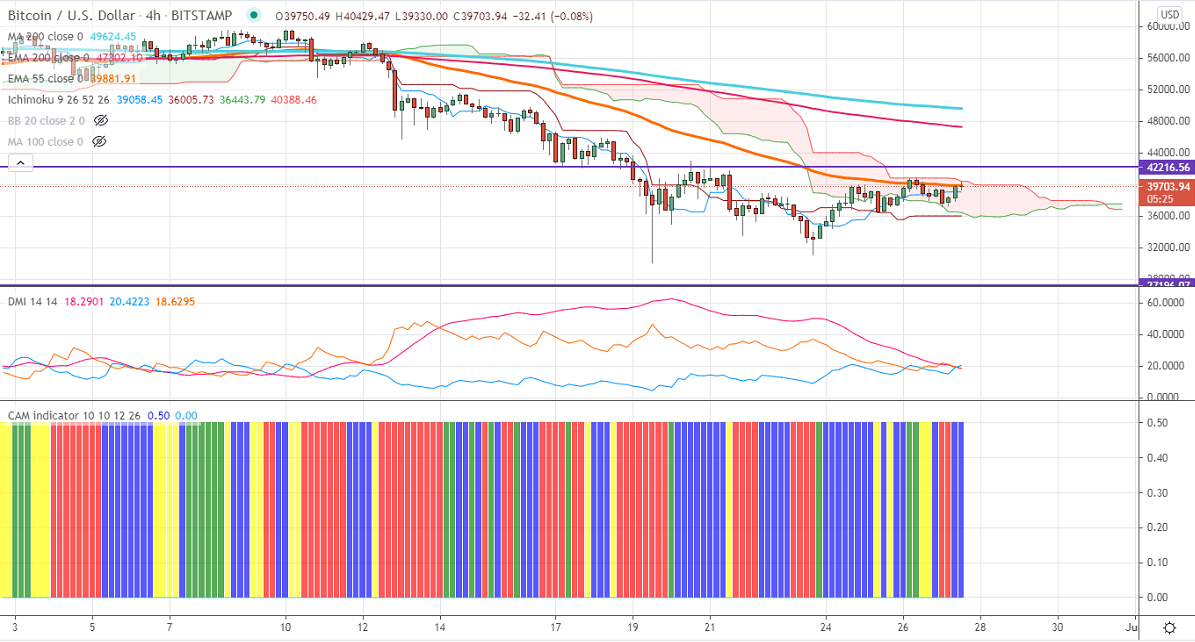

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $39058

Kijun-Sen- $36005

BTCUSD is consolidating in a narrow range with no major buying happening above $40000. The pair is still in bearish hands after a major sell-off in two days May 19th and May 23rd. The intraday trend is bearish as long as resistance $43000. Bitcoin surged more than 100% this year and hits an all-time high of $64895. It hits an intraday high of $40429 and is currently trading around $39720.

The near-term resistance is around $41000. Any indicative break above targets $43000/$44780/$47000. Short-term trend continuation above $47000.

The pair's minor support is around $36400. Any convincing break below will drag the pair down to $35000/$30000/$28392/$26948 (61.8% fib). Any close below $26900 will drag the pair down to $20000.

Indicator (4-Hour chart)

CAM indicator – Slightly bullish

Directional movement index – Neutral

It is good to sell on rallies around $39800-$40000 with SL around $43000 for TP of $28500.