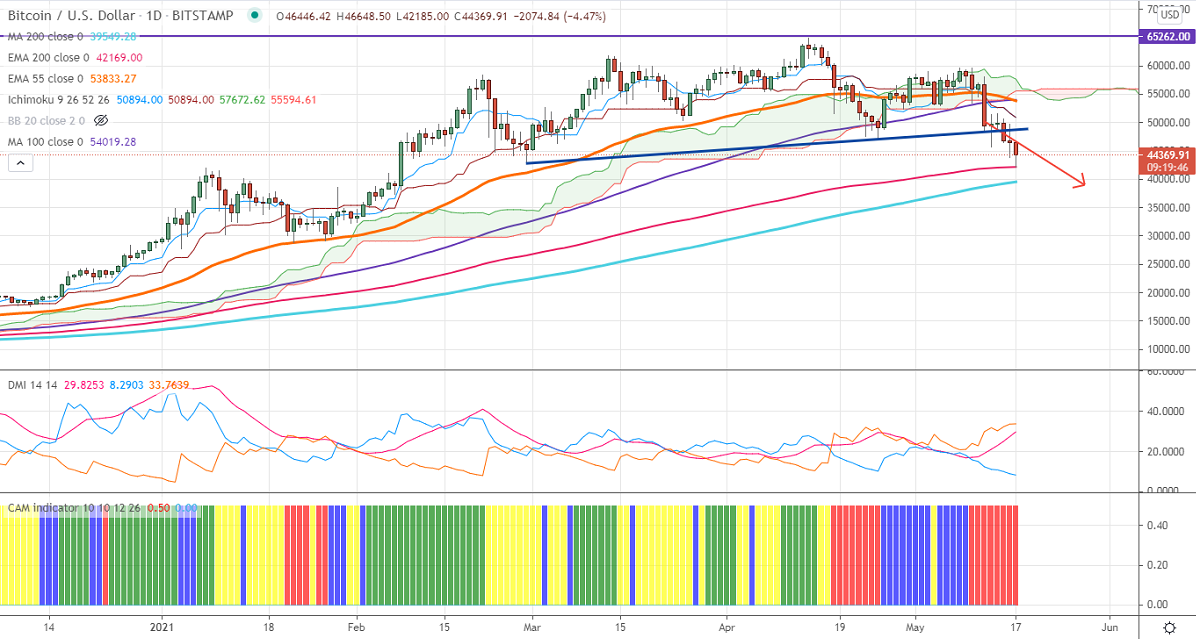

Ichimoku analysis (Daily chart)

Tenken-Sen- $51686

Kijun-Sen- $51686

BTCUSD continues to trade lower for third consecutive days and lost more than $8000. The Bitcoin surged more than 7% intraday after rumors about Tesla Bitcoin selling were denied. The pair hits a low of $42185 and currently trading around $44175. It was one of the worst performers in the past week and declined more than 35% from its all-time high of $64985. The intraday trend is weak as long as resistance $47000 holds.

The near-term resistance is around $47000. Any indicative break above targets $50000/$51700 $55000/$56650/$60000. Major trend continuation above $65000.

The pair's minor support is around $42000 (200- day EMA). Any convincing break below will drag the pair down to $39360 (200- day MA). Any close below $39000 will drag the pair down to $32500.

Indicator (Daily chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $47000 with SL around $50000 for TP of $39300.