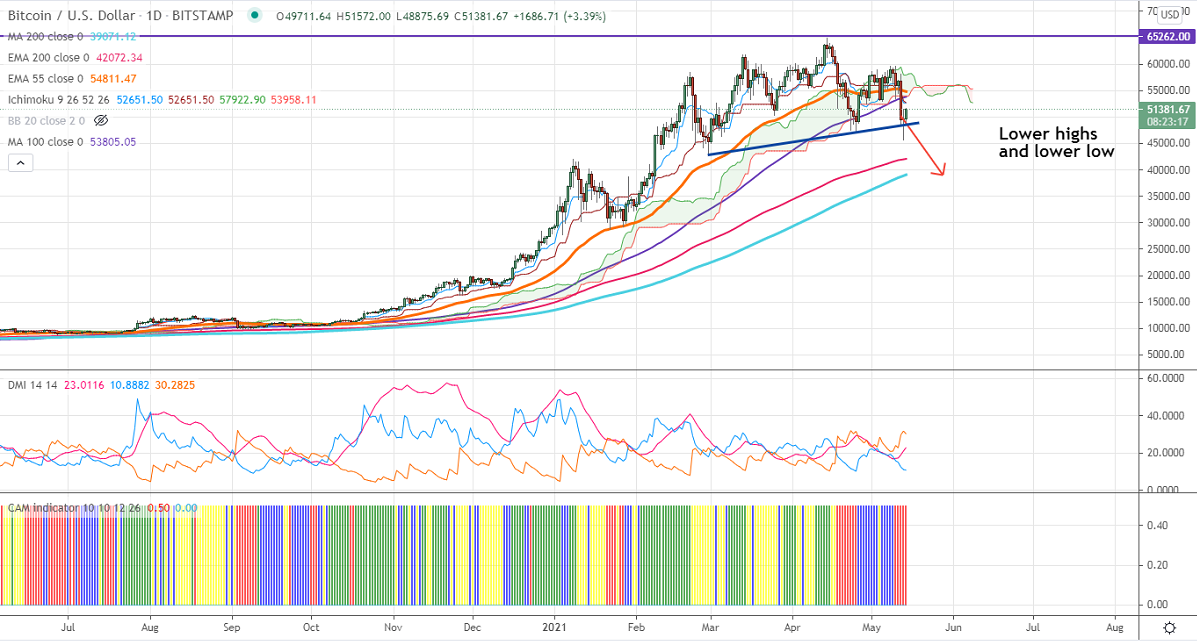

Ichimoku analysis (Daily chart)

Tenken-Sen- $52651

Kijun-Sen- $53068

BTCUSD recovered slightly after a minor decline below neckline support $48500. The pair hits a low of $45700 and bounced back above $50000. It was one of the worst performers this week after the Tesla announcement. The pair has formed lower highs and lower lows. This confirms further bearishness. A dip to $43000 is possible. The intraday bullishness can happen only if it closes above $54550. It hits an intraday low of $45700 and is currently trading around $49925.

The near-term resistance is around $53670. Any indicative break above targets $55000/$56650/$60000. Major trend continuation above $65000.

The pair's minor support is around $47000. Any convincing break below will drag the pair down to $43000/$40000/$38650 (200- day MA). Any close below $47000 will drag the pair down to $43000. Significant bearishness only if it breaks $43000.

Indicator (Daily chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $53000 with SL around $55000 for TP of $43000.