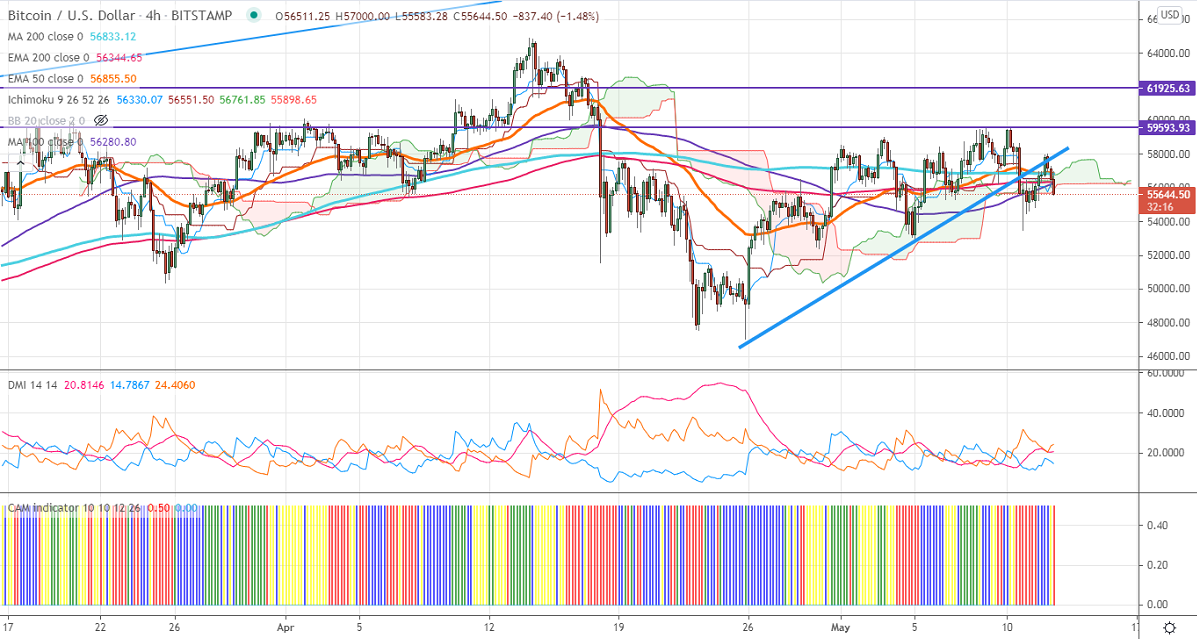

Ichimoku analysis (4-hour chart)

Tenken-Sen- $56260

Kijun-Sen- $56551

BTCUSD is consolidating in a narrow range between $59650 and 52950 for the past two weeks. The pair downside is capped by 100-day EMA and significant weakness only below that level. The break of wedge pattern confirms minor bearishness a dip till $53000. The intraday bullishness can happen only if it breaks $60000. It hits an intraday low of $55618 and is currently trading around $55807.

The near-term resistance is around $60000. Any indicative break above targets $61700/$65000. Major trend continuation above $65000.

The pair's minor support is around $55180 (61.8% fib). A break below will drag the pair down to$54500/ $52916 (100- day MA)/$47000. Any close below $47000 will drag the pair down to $43000. Significant bearishness only if it breaks $43000.

Indicator (4-Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $57000 with SL around $60000 for TP of $47000.