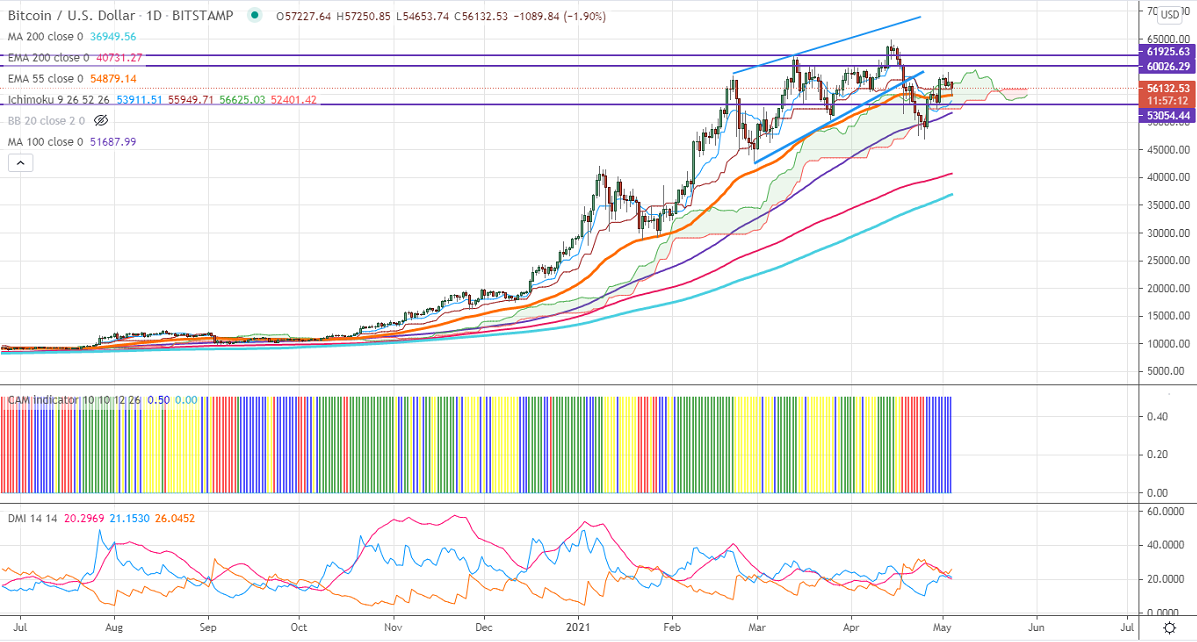

Ichimoku analysis (Daily chart)

Tenken-Sen- $53002

Kijun-Sen- $55949

BTCUSD declined more than $5000 after forming a temporary top around $59000. The pair is between $50000 and $60000 for the past week. Any significant trend continuation only if breaks $65000. The digital asset has formed a temporary bottom around $47000 and jumped more than $12000. The Bitcoin is holding above 50 and 100- day MA. It hits an intraday low of $54653 and is currently trading around $56202.

The near-term resistance is around $60000. Any indicative break above targets $61700/$65000. Major trend continuation above $65000.

The pair's minor support is around $54300.A break below will drag the pair down to $53000/$51449 (100- day MA). Any daily close below $51450 will drag the pair down to $47000/$43000. Significant bearishness only if it breaks $43000.

Indicator (Daily chart)

CAM indicator –Neutral

Directional movement index – Neutral

It is good to buy on dips around $53000 with SL around $50000 for TP of $64980.