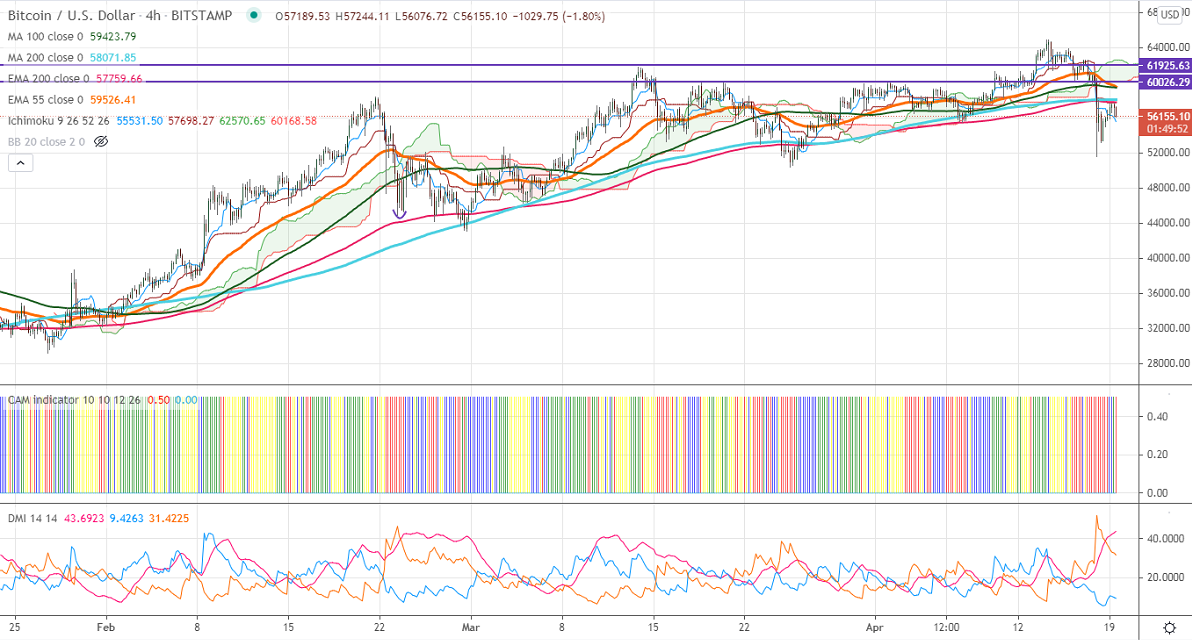

Ichimoku analysis (4-hour chart)

Tenken-Sen- $55987

Kijun-Sen- $57698

BTCUSD crashed more than 20% from its all-time high of $64895. The power outage in China and the ban of buying using Crypto by Turkey has dragged the prices sharply. The intraday trend is slightly bearish as long as resistance $58000. The pair is holding well below $60000 and is currently trading around $56500.The pair is trading below 4-hour Kijun-Sen, cloud, and slightly above Ten-Ken.

The near-term resistance is around $58000. Any indicative break above targets $59450-650 (100 4H MA and 55- 4H EMA)/$61700/$65000.Major trend continuation above $65000.

The pair's minor support is around $55000.A break below will drag the pair down till $53000/$50300/$49300 is possible. Significant bearishness only if it breaks $43000.

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index – Bearish

It is good to sell on rallies around $57900-$58000 with SL around $60000 for TP of $50300.