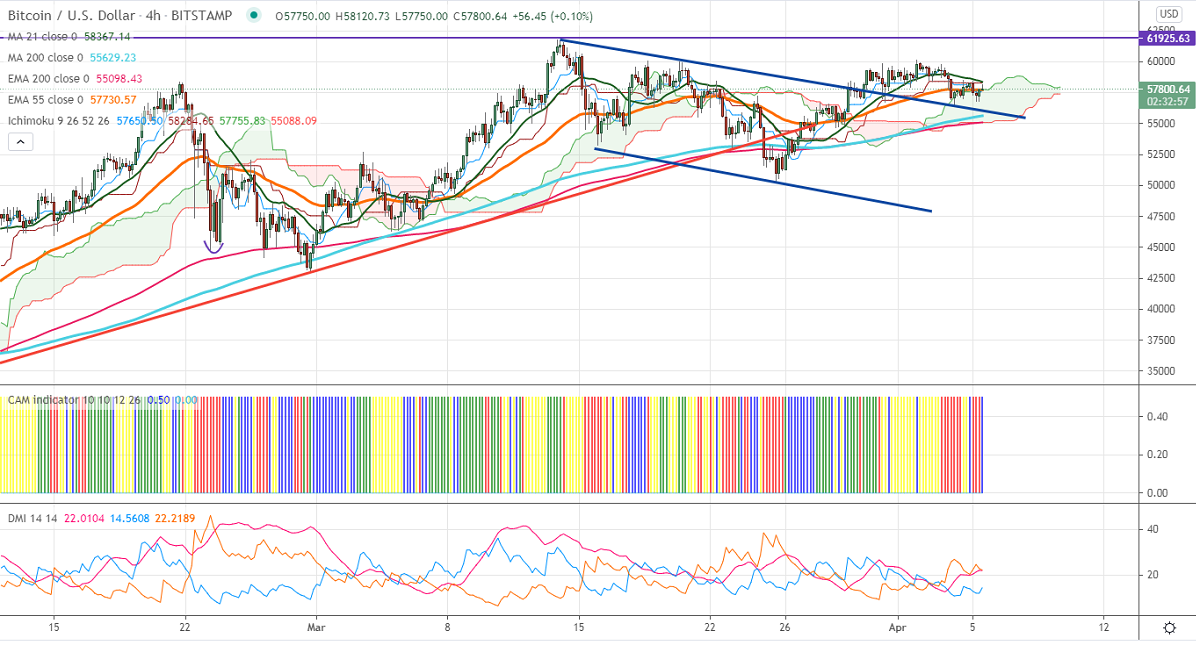

Ichimoku analysis (4-hour chart)

Tenken-Sen- $57483

Kijun-Sen- $58284

BTCUSD is consolidating after a minor jump above $60000.The overall trend is neutral as long as resistance $62000 holds. The pair is holding slightly above the 4-hour Tenken-Sen and cloud. But it is still below Kijun-Sen. The pair is holding above the Bull flag trend line, any violation below $56450 confirms minor weakness. It hits an intraday high of $58120 and is currently trading around $57914.

The near-term resistance is around $58500. Any indicative break above targets$60200/ $61700. Major trend continuation only above $62000.

The pair's minor support is around $56400.A break below will drag the pair down till $554200/$54980/54000 is possible.

Indicator (4 Hour chart)

CAM indicator – Neutral

Directional movement index – Bearish

It is good to buy on dips around $56400 with SL around $54980 for TP of $61700.