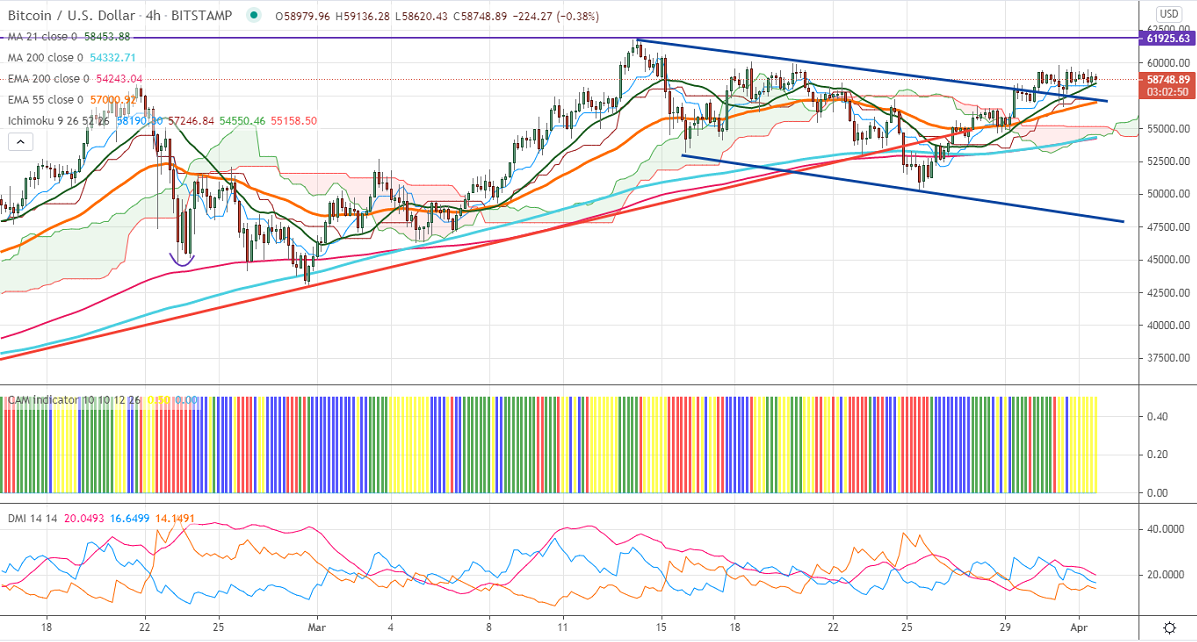

Ichimoku analysis (4-hour chart)

Tenken-Sen- $58264

Kijun-Sen- $57246

BTCUSD is consolidating in a narrow range between $56713 and $59667 for the past two days. The intraday trend is neutral as long as resistance $62000 holds. The pair is holding well above the 4-hour Tenken-Sen, Kijun-Sen, and cloud. The pair is holding above the Bull flag trend line, this confirms bullish continuation. Significant weakness only if it closes below the $54000 level. It hits an intraday high of $59816 and is currently trading around $58706.

The near-term resistance is around $60000. Any indicative break above targets $61700. Major trend continuation only above $62000.

The pair's minor support is around $56500.A break below will drag the pair down till $55000/$54197 is possible.

Indicator (4 Hour chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to buy on dips around $57000 with SL around $55000 for TP of $61700.