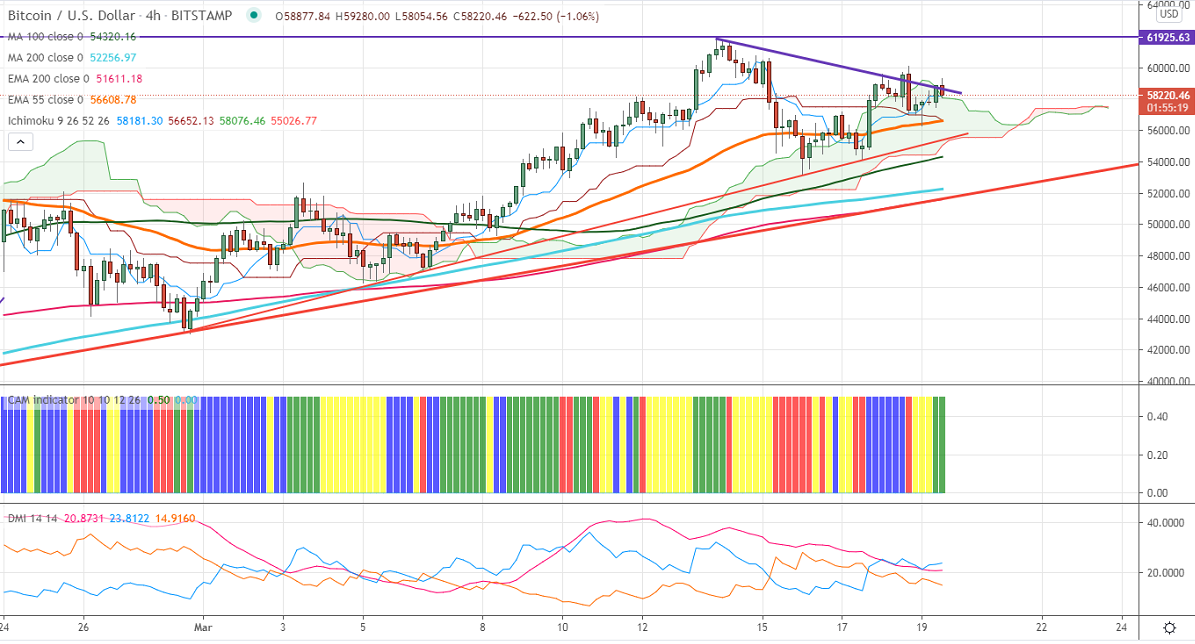

Ichimoku analysis (4-hour chart)

Tenken-Sen- $58181

Kijun-Sen- $56908

BTCUSD has once again declined after a minor jump above $60000. The strong buying in US dollar is putting pressure on this pair at higher levels. The overall trend is slightly on the lower side, as long as resistance $62000 holds. The pair is holding above 4 Hour Tenken-Sen and Kijun-Sen. Any violation below $56900 confirms minor bearishness, a dip till $56279/$55249 is possible. On Mar 16th, 2021 the pair took support near the trend line joining $43019 and $46529.This confirms shows that BTCUSD must close below $55300 for further minor weakness.

The pair's near-term resistance is around $62000.Any further bullishness can be seen if it breaks above that level. A jump till $64270/$67275 is possible.

Indicator (4 Hour chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to sell on rallies around $60000 with SL around $61700 for TP of $50000/$49300.