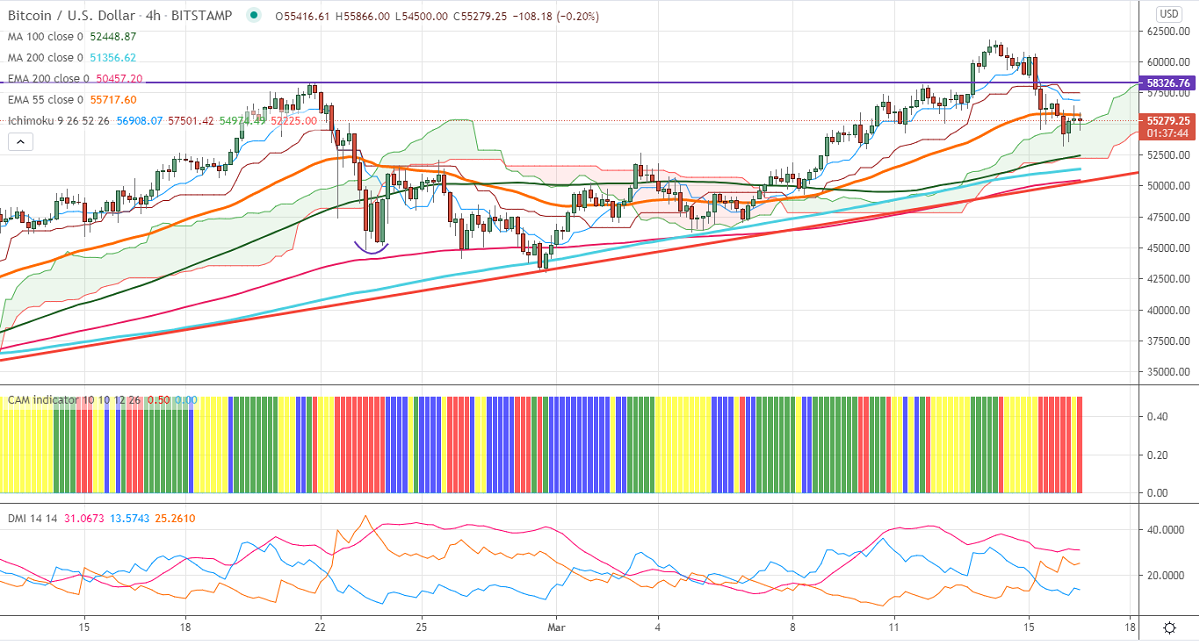

Ichimoku analysis (4-hour chart)

Tenken-Sen- $56900

Kijun-Sen- $57501

BTCUSD continues to trade lower for third consecutive days and lost more than 12% on the strong US dollar. The intraday trend is slightly on the lower side, as long as resistance $62000 holds. The pair is holding below 4-Hour Tenken-Sen and Kijun-Sen. Any below $52357 (100- 4H MA) confirms minor bearishness, a dip till $51300/$50400 (200- 4H EMA) is possible. On Mar 8th, 2021 the pair took support near 200- 4H EMA. This confirms shows that BTCUSD must close below $50400 for a further trend reversal. The support to be watched is $55000. Any violation below targets $54250/$53700/$53000.

The pair's near-term resistance is around $56500.Any further bullishness can be seen if it breaks above that level. A jump till $57400/$58300/$62000 is possible.

It is good to sell on rallies around $60000 with SL around $61700 for TP of $50000/$49300.