Bitcoin and other predominant cryptocurrencies have shown huge bearish effects yesterday, the bears are taking the downswings little further.

BTUSD tumbles from the highs of $9767.40 to the current $8805.20 at Bitfinex, ETHUSD drops from the peaks of $712 to $617.16, while ripple did the same though against US dollar from 0.9666 to 0.49801 but managed to recover to the current 0.7943 levels.

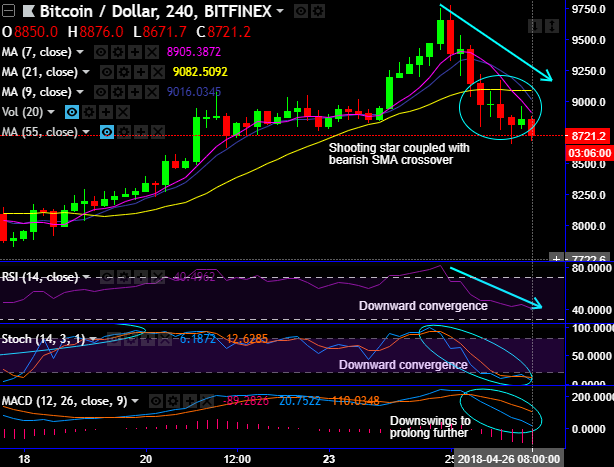

Shooting star patterns have occurred on the daily plotting of BTCUSD’s technical charts at $9681..9 (1H chart) and again at $8861 (on 4H chart). On the contrary, hammer pattern has also occurred at $8813 levels to counter these slumps (refer 1H chart).

However, both leading oscillators indicate that the bearish momentum is intensified (refer intraday chart). Both trend indicators are also indecisive but bearish bias.

As BTC futures are available at CME which are cash-settled. When you hold underlying outrights but stuck-up with catch22 situations in the prevailing bearish swings. The below derivatives strategy is the best suitable under such circumstances.

The short hedge strategy is advocated that could be utilized by bitcoin holders at the higher levels ($10000 above levels) and sitting with losses amid the lingering bearish sentiments, CME short futures contracts render services to lock in the price of underlying BTC prices to be settled sometime in the predetermined future. Hence, the short hedge is also known as output hedge.

The short hedge involves taking up a short futures positions while owning the underlying outrights to be delivered. Should the underlying BTC price tumbles, the gain in the value of the short futures position would be able to offset the drop in revenue from the sale of the underlying.

Never buck the trend should be thumb rule. You cannot question the market. Instead, by having such smart hedging positions can discover better entry and exit price levels.

Our currency strength indices are also indicating the same, FxWirePro's hourly BTC spot index that indicates the minor trend sentiments, is flashing at -70 levels (which is bearish in line with our above analysis), while hourly USD spot index was at 149 (bullish) while articulating at 08:46 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: