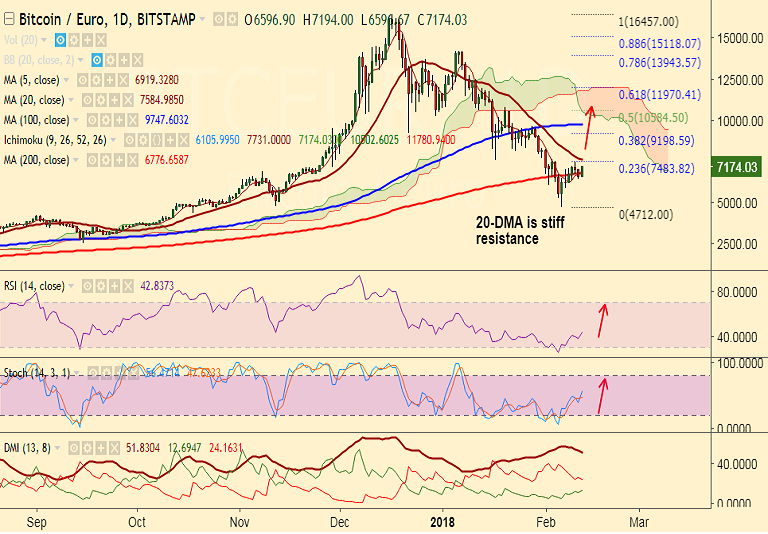

- BTC/EUR is struggling to extend break above 200-DMA, intraday bias is slightly bullish.

- The pair is trading 8.35% higher on the day at around 7146 levels at the time of writing.

- Price is retracing from multi-month lows of 4712, decisive breakout above 200-DMA could see further upside.

- Technical studies are turning bullish, RSI and Stochs are showing a rollover from oversold levels.

- MACD is on verge of bullish crossover, which if completed will add to the bullish bias.

- Upside finds stiff resistance at 20-DMA at 7582. Breakout could see further upside.

- On the flipside, failure at 200-DMA will invalidate bullish bias. Scope for test of 5500 levels.

Support levels - 6776 (200-DMA), 6910 (5-DMA), 5488 (78.6 % Fib retrace of 2502 to 16457 rally), 5000, 4712 (Feb 6 low)

Resistance levels - 7483 (23.6% Fib retrace of 16457 to 4712 fall), 7500 (Feb 4 high), 7583 (20-DMA)

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary