Uncertainty is mounting in Brazil and BRL is pressurized by various factors as stated below.

If Henrique Meirelles assumes the office of finance ministry in the upcoming weeks, we ponder that the initial market reaction could be constructive. But USDBRL price action should continue to be dominated by uncertainty about the political and fiscal situation in Brazil.

However, we remain skeptical that it will be a game changer, as there is no clear plan either to improve potential output by pushing structural reforms or to cut discretionary spending.

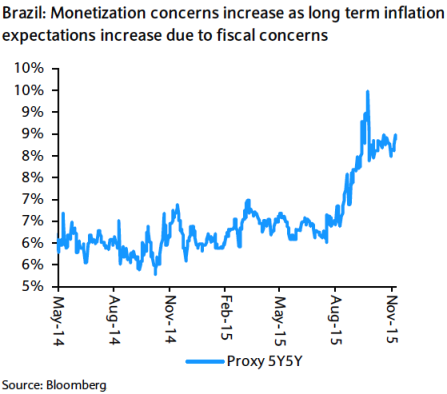

Therefore, we continue to think that USDBRL will move towards 4.00 levels back again in the months to come as monetization concerns increase. Thus, we keep adding Longs in USDBRL exposure via an outright in the money call.

Data-wise, we expect the unemployment rate (Thursday) to increase 10bp; however, once seasonally adjusted, we forecast a stronger deterioration of 30bp. Formal job eliminations and lack of confidence in an economic turn suggest that the deterioration in the labor market could continue.

In Mexico, we reckon that USDMXN will keep inching towards 17.00 levels, toward our forecast of 17.50 in the year to come as the USD resumes its upward trend and headwinds from EM weigh on the MXN. Although we have a constructive stance on Mexico, we wouldn't like to have currency exposure because of its high correlation with risky assets.

FxWirePro: BRL continue to tumble due to fiscal pressures, risky assets pressurize on MXN

Tuesday, November 17, 2015 2:20 PM UTC

Editor's Picks

- Market Data

Most Popular

7

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings