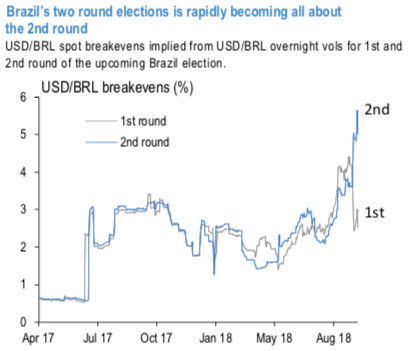

Long expiry BRL call ratios: At the currently fairly extended pricing of the 2nd round of the election event risk (refer above chart) the curve is unlikely to invert much further. Vol surfaces tend to drop after election events roll off, though within all likelihood of a sharp jump or drop in USDBRL spot the vol roll off is tricky to execute via outright vol structures. Low cost front tenor calendars of type short 6wk BRL call vs. long 2M BRL call spreads are problematic due to a high likelihood of a significant BRL spot /sell-off following the election announcement (6-8%).

Instead we focus on long expiry USD/EM puts where liquidity should be ample and explore possibility of monetizing net short vega 1Y 1*2 USDBRL put ratios. The idea is to position short vega without exposure to the BRL tail risk, therefore presenting potential for a low-risk way of playing the inevitable de- pricing of the surface once the event rolls off. If any, vol upside should be limited to gamma tenors and could be capped as the BCB is set to intervene more aggressively via FX swaps. 6M-1Y tenors should be fairly immune to the ongoing liquidity squeeze.

The 1st nutshell displays post-election returns from 1Y USDBRL 40D/25D 1*2 put ratio for various scenarios of changes in USDBRL spot and vols post-election. The two highlighted regions are meant to capture two distinct scenarios: market friendly(er) outcome is highlighted in green (5-7pts vol selloff and USDBRL spot drop of 4-6% soon in the aftermath of the election results – this is in line with the client survey) and the less market friendly outcome highlighted red (USDBRL jumps 6-8%). The strike selection is depicted in the 2nd nutshell.

The structure finishes ITM across most of the spot-vol grid from the 1st nutshell though in event of a significant overshoot (e.g. USDBRL spot drops by more than 8%) returns would sharply falter.

While 40D/25D structure is our preferred choice for its simplicity one could consider a mix of 1Y USDBRL 25D/10D 1*2 put ratio and 1Y USDBRL 40D/25D 1*2 put ratio (effectively a put strangles) which allows for a much wider range of downside USDBRL spots and still be ITM. Risk reward of such structure is a solid 1:8.2.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 86 levels (which is bullish), while articulating (at 12:20 GMT). For more details on the index, please refer below weblink:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close