In just last six months, GBPCAD has shown strength against major downtrend from the lows of 1.8103 to the current 1.9084 levels, (i.e. almost 5.41%).

In UK, the BoE has been maintaining an unchanged interest rate at 0.50%, all MPC members unanimously voted for this decision.

The main reason behind this decision is that the BoE would not want to put any additional strain on the markets amid Brexit decision ahead in this month and the British economy by allowing any speculation about an adjustment of its monetary policy.

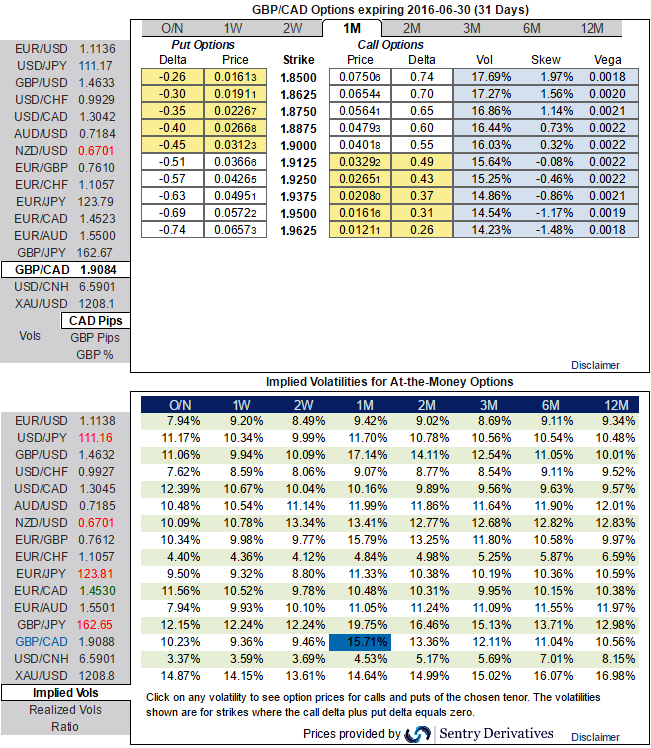

Elsewhere, in OTC markets, ATM IVs of all GBP pairs responding crazily to these economic events to factor in these weakness in this pair as we could see reasonable increase in IVs of 1W and 1M tenors of all GBP crosses, while skews of these vols indicate OTM striking calls may go unproductive as they flash higher negative values.

Well, stated in another way, it is the difference in IV between out-of-the-money, at-the-money and in-the-money options and also different expiration periods.

Option premiums will rise and fall with volatility. These pricing models make the incorrect assumption that volatility is constant throughout each respective strike price and regardless of duration. Supply and demand will never allow these conditions to exist.

It is, however, possible to calculate IV for different strike prices and over different time frames by using the current options price as a given, using the other five inputs listed above and then solving for that specific IV.

As a result, we recommend capitalizing on the sustainable rise in IV factor by employing ITM short puts as there central bank's decision was in line with market's expectations and matching this with ATM longs to construct short term back spreads that is likely to fetch positive cash flows as per the indications by sensitivity table.

When trying to assess how a spread may perform, look at the spreads of deeper in-the-money options for an indication of relative option prices. (For a demonstrated purpose we’ve used 1% ITM instruments, in real times use longer expiries on ATM longs.

So, keeping all these attributes in mind, here goes the strategy, go long in 1M 2 lots of ATM -0.50 delta put, and in 2M (0.5%) OTM -0.35 delta puts, while shorting 1 lot of ATM put and (0.5%) OTM put with both expiries of 1 week.

Idea is to get more cushion from the shorting premiums as there is no deviation from central bank's decision, subsequently, the slight upward or sideway swings would derive the positive cashflows through the initial receipts of shorts which could be utilized for reducing hedging cost.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data