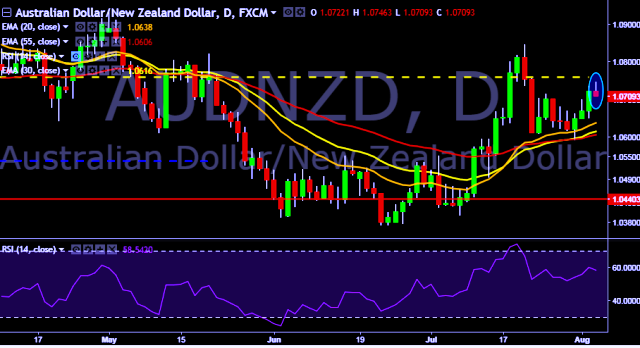

- AUD/NZD is currently trading around 1.0709 marks.

- Pair made intraday high at 1.0746 and low at 1.0708 marks.

- Intraday bias remains slightly bearish till the time pair holds key resistance at 1.0754 marks.

- A daily close below 1.0722 will take the parity down towards key supports around 1.0649, 1.0590, 1.0443, 1.0371, 1.0326 and 1.0237 marks respectively.

- On the other side, a sustained close above 1.0754 will drag the parity higher towards key resistances at 1.0865/1.0912/1.0966/1.1062/1.1148 levels respectively.

- Australia June trade balance G&S (A$) decrease to 856 mln aud (forecast 1800 mln aud) vs previous 2024 mln aud (revised from 2471 mln aud).

- Australia June goods/services exports decrease to -1 % vs previous 9.0 %.

- Australia June goods/services imports increase to 2 % vs previous 1.0 %.

- Australia AIG performance of services index rose 1.6 points to 56.4 in July.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest