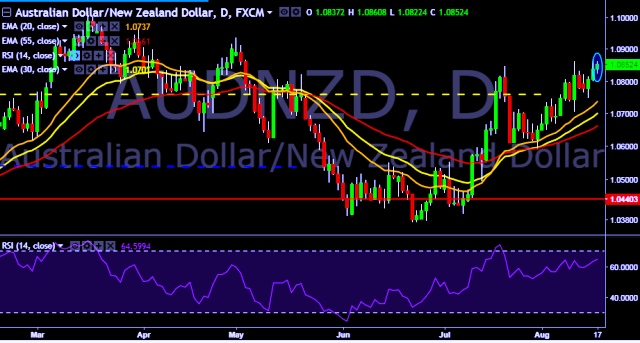

- AUD/NZD is currently trading around 1.0853 marks.

- Pair made intraday high at 1.0860 and low at 1.0822 marks.

- Intraday bias remains bullish till the time pair holds key support at 1.0798 mark.

- A daily close below 1.0838 will take the parity down towards key supports around 1.0798, 1.0737, 1.0693, 1.0649, 1.0590, 1.0443, 1.0371, 1.0326 and 1.0237 marks respectively.

- On the other side, a sustained close above 1.0838 will drag the parity higher towards key resistances at 1.0912/1.0966/1.1062/1.1148 levels respectively.

- Australia July employment increase to 27.9 k (forecast 20.0 k) vs previous 20 k (revised from 14.0 k).

- Australia July unemployment rate decrease to 5.6 % (forecast 5.6 %) vs previous 5.7 % (revised from 5.6 %).

- New Zealand Q2 producer price index inputs +1.4 pct vs previous quarter.

- New Zealand Q2 producer price index outputs +1.3 pct vs previous quarter.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest