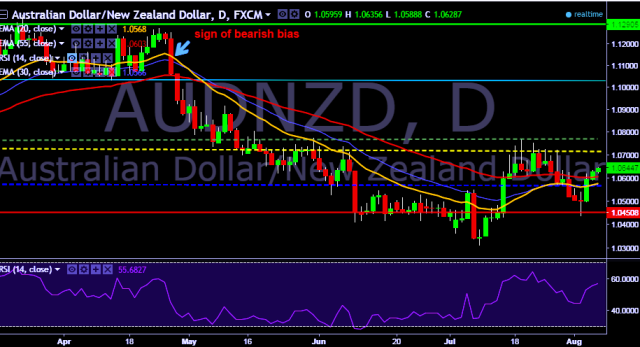

- AUD/NZD is currently trading around 1.0641 marks.

- Pair made intraday high at 1.0647 and low at 1.0619 marks.

- Intraday bias remains bullish till the time pair holds key support at 1.0623 levels.

- In addition, a sustained close above 1.0623 will drag the parity higher towards 1.0727/1.0823/1.0976 (January 2016 high) /1.1062 (30D EMA) /1.1123/1.1298/1.1317 levels respectively.

- Alternatively, a sustained break below 1.0588 mark will take the parity down towards key supports around 1.0497, 1.0450, 1.0420, 1.0315(May 05, 2015 low), 1.0261 and 1.0109 marks respectively.

- Important to note here that in a daily chart, 20D, 30D and 55D EMA heads down and confirms the bearish trend. Current upside movement is short term trend correction only.

- RBA: Underlying inflation to remain under 2 pct for much of forecast period, reach 2 pct by end 2018.

- RBA: Prospects for economy positive, but low inflation allows for "even stronger growth".

- RBA says A$ remains significant source of uncertainty for inflation, growth forecasts.

- RBA forecasts underlying inflation 1.5 pct by end 2016, 1.5-2.5 pct end 2017, 1.5-2.5 pct end 2018.

- RBA forecasts GDP growth 2.5-3.5 pct end 2016, 2.5-3.5 pct end 2017, 3-4 pct end 2018.

- RBA says unemployment to fall only a little out to 2018, employment growth to be modest this year.

- RBA quarterly statement repeats policy easing to help foster growth, offers no forward guidance.

FxWirePro: Aussie gains against major peers after RBA’s monetary policy statements

Friday, August 5, 2016 2:03 AM UTC

Editor's Picks

- Market Data

Most Popular