The Aussie dollar has been one of the worst performers in the broad-based US dollar rally since the June FOMC and ECB meetings. The Federal Reserve’s monetary policy announcement provides the focus for today. Given the FOMC raised the Fed funds rate to 2% (upper bound) in June.

The low OIS-implied probability of a hike (20%) arguably overstates the chances. While fireworks aren’t expected from the initial announcement, all eyes will be primed for any changes to the post-meeting press statement. The Fed is likely to acknowledge the strength of recent data, including the 4.1%y/y rise in Q2 GDP.

While Australia’s key commodity prices have still been broadly resilient; especially LNG and thermal coal, suggesting AUD downside should be contained multi-month. The RBA should also be optimistic about Australia’s growth outlook in its Aug statement. We look for 0.75 in near terms.

Contemplating all these drivers, AUDUSD is forecasted to slide towards 0.72 by 3Q’18. Both monetary policy divergence and minimal support from commodity prices to nudge the currency lower over time. Furthermore, the pace of domestic growth momentum is also expected to weaken in 2H’18, after a boost from net exports in the first half of the year. Recent developments around the Banking Royal Commission have likely shifted risks to that forecast to the downside.

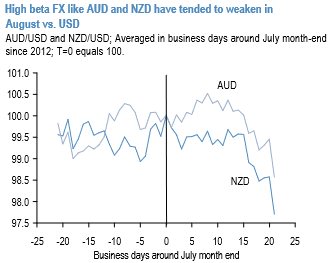

Near-term seasonals are on the margin are also supportive of the bearish view on high beta FX, as USD typically tends to strengthen in August vs high beta FX (AUDUSD and NZDUSD on average have weakened by 1.4% and 2.3% in August over the past 5-years, respectively; refer 1st chart).

Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.72 levels (above nutshell). While we see the mild positive shift in bearish delta risk reversal indicates that the hedging activities for the downside risks remain intact amid mild momentary upswings.

We use such shifting and absolute risk reversals numbers to forecast trends and shifts in trends. Even then for more accuracy it’ is unwise to rely completely on the absolute Risk Reversal (RRs) number while devising strategies. Hence, it is better that the RRs are coupled with positively skewed IVs as diverse dynamics and the constantly changing driving forces across the globe complicate standardization of strategy rules. As you could observe the skews are well in line with the above-stated FX projections.

Currency Strength Index: FxWirePro's hourly AUD spot index has turned 114 levels (which is highly bullish), while hourly USD spot index was creeping towards at -6 (absolutely neutral) while articulating (at 10:34 GMT). For more details on the index, please refer below weblink:

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis