- Aussie bulls fail to benefit from upbeat China data, AUD/USD slips from multi-month peaks at 0.7834.

- Data on Friday showed US headline CPI unchanged on a monthly basis and yearly rate sliding further below the Fed's 2.0% medium-term range.

- Adding to disappointing inflation figures, monthly retail sales data contracted for the second straight month, further diminishing prospects for additional Fed rate hike action.

- AUD/USD surged past 0.78 handle, highest since April 2016 on Friday.

- The pair is seeing some profit booking on the day, has slipped from highs of 0.7831 to currently trade at 0.7812 levels.

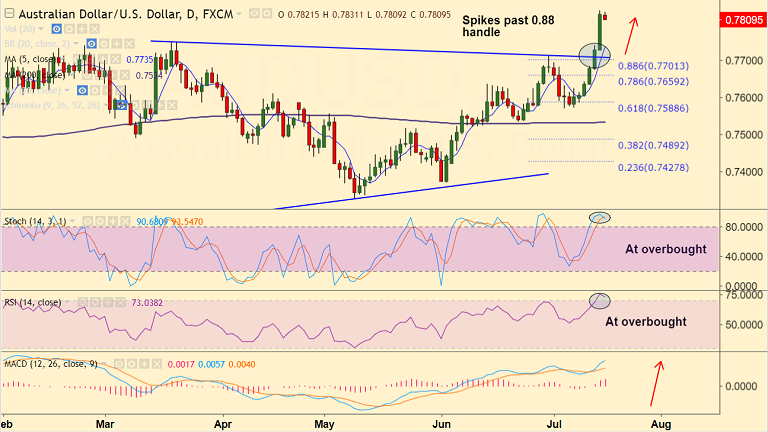

- The major finds immediate support at 0.78 (1H 20-SMA). Break below could see drag upto 0.7736 (5-DMA).

- Any break below 5-DMA could see extension of weakness. 20-DMA at 0.7637 will be next major support.

- Daily momentum indicators are in highly overbought zone, we see scope for some correction.

Support levels - 0.78 (1H 20-SMA), 0.7736 (5-DMA), 0.77, 0.7637 (20-DMA)

Resistance levels - 0.7835 (Apr 2016 high), 0.7849 (June 2015 high), 0.79, 0.7912 (Feb 2015 high)

Call update: Our previous call (Our previous call (http://www.econotimes.com/FxWirePro-AUD-USD-holds-20-DMA-support-bias-higher-good-to-go-long-on-dips-795926) has hit all targets.

Recommendation: We expect some consolidation at current levels. Watchout for break below 20-DMA for weakness.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.