Rotate long EURCHF into long USDCHF via risk reversal; keep EURUSD call spread, the much-awaited ECB meeting was modestly dovish and with it, Draghi was able to deliver euro weakening alongside a QE “taper” announcement for the second time in a year.

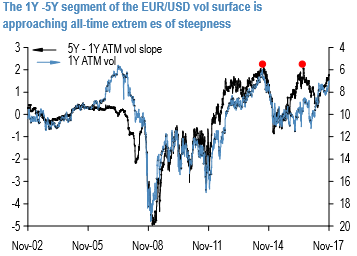

Increasing steepness of vol curves is not just a sub-1Y phenomenon. One liquid long-dated G7 surface that we are closely monitoring for signs of extreme curve shape is EURUSD, where the 5Y –1Y vol spread is close to all-time wides (refer above char).

This is not a traditional RV dislocation in the strict sense of the term, since the curve is fair relative to the level of vol i.e. the entire curve move in recent months can be explained by the cratering of 1Y vol; by extension then, normalization of the curve should be led by a reversal higher in the latter.

This back-end vol slope in EURUSD is worth tracking closely because the last two major peaks in curve steepness in 2014 and 2016 acted as major mean reversion pivots for 1Y vol over coming months (refer above chart).

The current slope (1.8 % pts.) is 0.3 pts below prior peaks, our intent is to start legging into EUR 1Y ATMs perhaps 0.3-0.5 vols lower from the current market once we see a 2-handle print on the curve.

Given the depth of the Euro option market, owning EUR vol from near two decade lows constitutes the most scalable FX risk premium normalization trade for 2018 in our view.

Separately, the EURUSD call spread is near worthless and thus we maintain that position. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at 121 levels (which is highly bullish), while hourly EUR spot index was at shy above 61 (bullish) while articulating at 07:26 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?