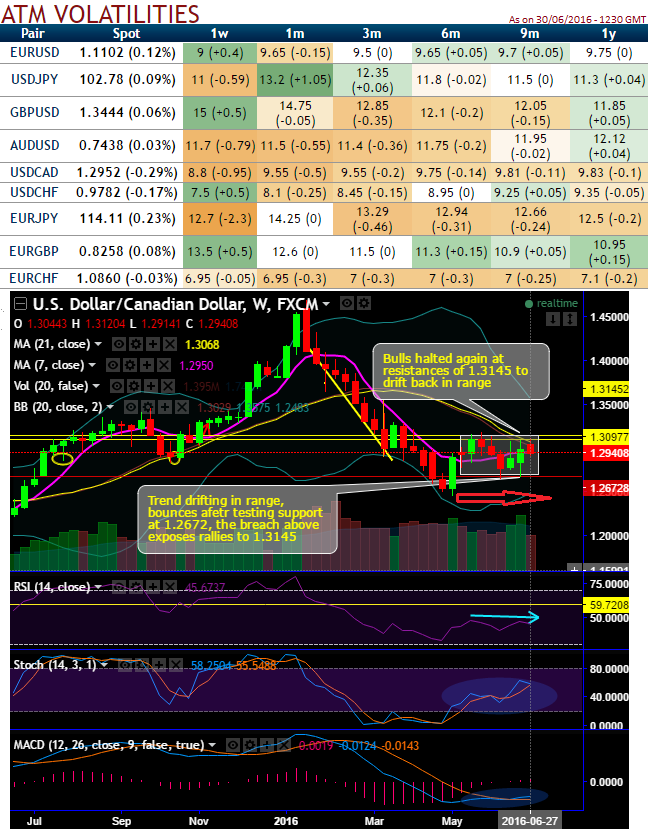

Although the prices of USDCAD are trying bounce from last 2 weeks, now remained well below 21DMA that has pulled back into the sideway range lasted for 7 weeks.

Lower IVs of ATM contracts have been lacklustre (1w tenors showing 8.8%) and seem like below 10% in long run.

Any huge disparity exists between option premiums and IVs should a raise a cause of concern as to whether spot FX would move in sync with risk reversals or not.

As we foresee narrow range trend is puzzling this pair on both intraday and weekly charts,

It also shows the neutral risk reversals which indicate underlying spot FX is anticipated to remain in the existing range.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon.

Contemplating the tepid IVs the iron condor option strategy appears to be more suitable in current trend of USDCAD.

So, go short in OTM put and long in deep OTM put, simultaneously, go short in OTM call and long in deep OTM call of similar expiries.

These positions may result in a limited risk, and in non-directional trend to have the large probabilities of earning the limited returns when the underlying spot FX is perceived to have low volatility.

The iron condor strategy can also be visualized as a combination of a bull put spread and a bear call spread.

Maximum returns for the iron condor strategy is equal to the net credit received when entering the trade.

Maximum profit is achievable when the underlying spot fx at expiration is between the strikes of the call and put sold. At this juncture, all the options would expire worthless.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?