Since June, NZDUSD has been trading in the 0.70-0.74 range after a bullish first semester. At this stage, the interest rate differential already points towards a much lower NZDUSD, in the direction of our end-2017 forecast (refer above graph).

As the RBNZ cut rates by 25bp for the third time of the year at its 9th November meeting. After the cut, Assistant Governor McDermott stated that currency strength is clearly undesirable, as it would weigh on trade and exert downward pressure on inflation expectations. With the RBNZ still having the highest G10 rate at 1.75%, the market could come to expect another 25bp cut next year, thereby catching up with the RBA at 1.50%. Within the Q2’17 horizon, both a hike and a cut are priced with a probability below 10%.

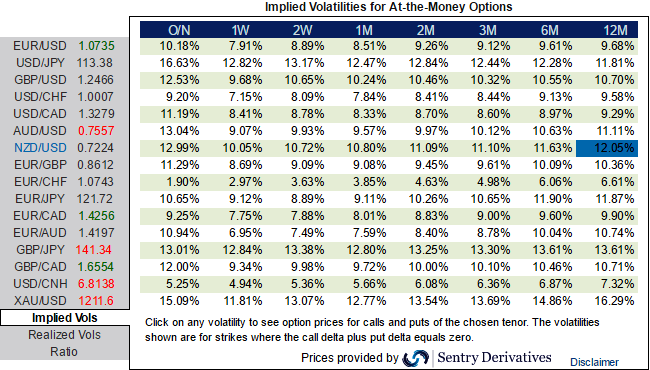

Downside medium-term kiwi volatility seems to be costly if we consider that NZDUSD 1y IVs rose above 12% while 3m realized volatility sharply fell after the summer to return to around 10% (refer IV nutshell). We expect the down move to be relatively slow next year, and in any case, it is unlikely to lift implied volatility even higher compared to the mild spot dynamics. The skew is also firmly oriented towards dollar puts, such that the volatility picture suggests selling the kiwi via RKO puts.

Buy NZDUSD 1y put strike 0.68 RKO 0.59, indicative offer: 0.98% (vs 3.85% for the vanilla, spot ref: 0.7224) Trade risks: limited to the premium. Investors buying a barrier option cannot lose more than the premium initially invested. However, the option would cease to exist if underlying NZDUSD spot hits 0.59 on or before the 1y tenor.

Hence, we recommend buying NZDUSD 1y put with a strike at 0.68, just below the 0.70 resistance, and an American knock-out barrier at 0.59, just below the 0.60 psychological support and five figures below our end-2017 forecast of 0.64. This trade embeds negative convexity and is therefore purely buy-and-hold since the potential leverage cannot be monetized before the expiry. The advantage is that the risk is limited to the premium paid, an attractive feature for a cheap short volatility trade, costing less than a third of the equivalent vanilla.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios