We’ve stated in our recent posts about euro positive skewness. But the options skew reflects the relative appetite for calls and puts, which only partly reflects pure directional expectations. The skew is primarily about volatility expectations conditional on a scenario on the spot. The sensitivity and focus on reassessing central bank policy, and the ongoing vulnerability of the dollar. The theme of Europe leading outperformance remains dominant; maintain core EUR or proxy longs as data continue to be supportive, but increase USD shorts.

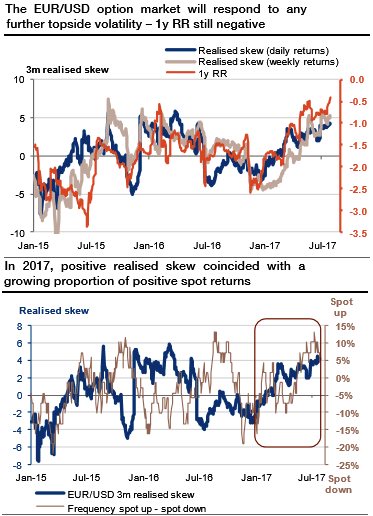

Market makers essentially trade the skew as per their perception of topside compared with downside volatility. To this end, we computed a realized skew that can be used like realized volatility. Namely, we computed the spread between two exponentially weighted realized volatilities, based on positive and negative returns (refer above chart). Dollar weakness continues to preserve prevailing vol themes of gamma strength, curve flattening and risk-reversal softness.

When the realized skew is positive, it shows that the FX rate experiences more topside than downside volatility. As expected, this metric is strongly correlated to the risk reversal. One could argue that using daily returns only captures market nervousness or noise, instead of meaningful spot moves.

So we also computed the realized with weekly returns instead of daily returns, and observe that our realized skew is relatively insensitive to the returns frequency. If we zoom in on the recent period, the EURUSD daily realized skew switched to positive territory in early March, while the weekly realized skew made this move at end-April. This fits with the EURUSD break of 1.08 right after the first round of the French presidential election.

Societe Generale reckons that the options market should respond to further topside vol:

Even if it has not always been true, the rise in the realized skew observed in 2017 happened on the back of a growing proportion of EURUSD positive returns (refer above chart). If EURUSD vol rises from limbo as the spot overshoots upwards, risk reversals should exhibit more bullishness.

As we have emphasized, the ECB still has to clarify how the QE process will reverse. The 2015-17 EURUSD range corresponded to its asset purchase period, and, more globally, the negative skew period (since 2009) corresponded to global central banks’ accommodation. As the market is still awaiting the next steps from the ECB and Fed, the full positive impact on the EURUSD skew is probably yet to be seen.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings