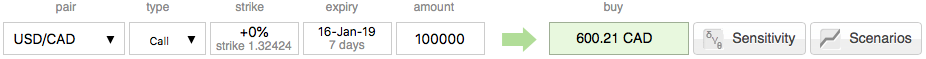

Please be noted that CAD call options seem to be overpriced as there exists disparity between the implied volatilities, pricing and NPV. USDCAD call options are trading at CAD 600.15, whereas the net present value is at 511 with IVs of 1m tenor is just shy above 7.8%, hence, these bullish derivative instruments are overpriced at 17.4%

The CAD is up modestly against G10 currency peers, and especially CADJPY is showing all signs of extension of its recent recovery while outperforming all of the G10 currencies into Tuesday’s NA session.

Domestic risk returns with the 8:30am ET release of international merchandise trade data for November, ahead of today’s Bank of Canada policy decision (quite a few expect for 25 bps hike and few expect it to be on hold) and MPR forecast update. Near-term rate expectations remain relatively muted however the recent curve inversion appears to be fading following the market dislocations from late December/early January. U.S.-Canada yield spreads are fading their recent contraction and the outlook for relative central bank policy presents a near-term headwind, given the aggressive recovery in Fed expectations. While crude oil prices remain critical as WTI nears the psychologically important $50/bbl level and measures of sentiment offer additional support as lower measures of implied volatility reduce the premium for protection against CAD weakness.

Overall, we are neutral-bullish into this week’s BoC, given the CAD’s impressive 3.2% rally from the Dec 31 low.

There are no doubt arguments for why the Bank of Canada (BoC) could take a break in the rate cycle tonight, as 3⁄4thof the market expects. At its December meeting it maintained its restrictive approach but it sounded a little more cautious than in October when it hiked the key rate by 25bp to 1.75%.

The CAD could no doubt cope with a rate hike even though it would no doubt push the CAD much higher in view of the market expectations. As long as USDCAD remains above 1.28-1.30 though the BoC is unlikely to worry. Courtesy: sentrix, ore

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 71 levels (which is bullish), hourly USD spot index was at -96 (bearish) while articulating at (09:45 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand