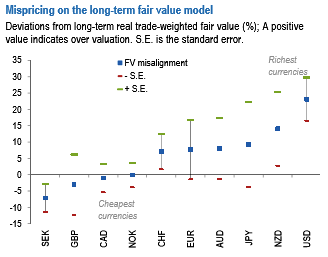

There has been substantial movement in G10 currencies over the past month, but the ranking of currencies on this framework hasn’t changed.

Despite JPY and CAD underperforming in the past month and GBP and EUR outperforming over the same period. USD, NZD, and JPY remain the richest currencies ranked on this metric, while SEK, GBP, CAD, and NOK remain the cheapest.

GBP REERs have strengthened by 2.5% in the past month, pushing the currency closer to fair value on this metric. GBP misalignment on this frame now at the upper end of its post-Brexit range, indicating a further dissipation of political premium.

Valuations divergence has continued to persist in commodity currencies with AUD and NZD still screening rich vs. CAD and NOK. Petro-currencies have underperformed in the past month, aided by the slide in oil prices. Their valuations are still near fair value (refer above chart), but still depressed from the long-run point of view. Between the two petro-currencies, NOK offers marginally more value and our macro narrative is also more NOK-supportive.

CAD and NOK valuations continue to appear quite cheap relative to Antipodeans (refer above chart), where valuations are still rich despite recent corrections. NZD is the richer off the two (refer above chart). Both currencies continue to face further downside in this framework as well in our forecasts, especially vs. EM high yielders. While JPY has been in focus, with the REER reaching a 6 month low. Despite this underperformance, JPY continues to look 8% rich on this framework.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed