Take a quick glance at drivers of Euro: It looks as if the dollar wanted to annoy the US President. On the first trading day after his grumbling about the strong dollar, the greenback appreciates against the euro. However, the moves on the FX market were choppy and mixed, which makes it difficult to explain. The euphoria about a possible deal between the US and China was pretty limited in the end so that risk sentiment on the market remained fairly subdued. However, the euro’s losses may also be down to the fact that following ECB officials commenting more cautiously on the growth outlook in the eurozone the ECB’s new projections on Thursday might paint are more subdued picture than before.

The market might already be pricing in a slightly more cautious ECB, which is why the euro is already aiming for the 1.13 mark.

It seems to be in deep in carry-hunting season in FX markets, however, the obvious targets within individual G7 option surfaces are quite tough to figure out in light of the massive ongoing compression in the vol risk premium. We refer to JPM’s correlation analysis that could offer an outlet for the non-directional carry chaser when the well of usual vol carry trades is running dry. It is easier said than done though due to the illiquidity of the clean correlation product in FX markets (corr. swaps) and the heavy maintenance/operational complexity associated with managing delta-hedged vanilla triangles that replicate the correlation swap.

We propose a buy/sell-and-hold approach of monetizing correlations without the need for continuous delta-hedging and/or strike management via carefully constructed vanilla option triangles with ‘closed delta loops’.

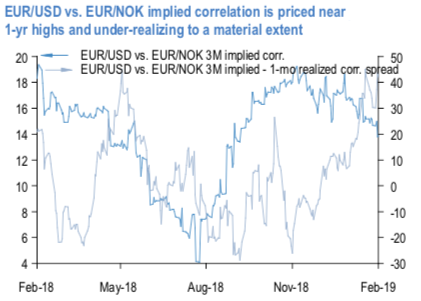

The above charts provide an example of such a construct. The correlation pair in question is EURUSD vs EURNOK, which is a natural de-coupling candidate given the hub-spoke

relationship of core Europe vis-à-vis smaller satellite economies of Scandinavia (and CEE). Because these smaller economies typically have a growth beta > 1 to core European growth, their USD-pairs tend follow with a beta >1 to EUR, with the result that their Euro-crosses usually move in the opposite direction to EURUSD – unless of course the normal cyclical linkage is deliberately torpedoed by unconventional central bank policy (Sweden).

As a result, options markets typically factor in tepid sub-20% implied correlations between EURUSD and EUR/Scandi crosses, which still often proves excessive relative to realized corrs.

In the current instance, EURUSD – EURNOK 3M implied corr. in the mid-teens is elevated by historical standards and has begun to inflect lower, but more crucially is priced a sizeable 30-40 %pts. above recently delivered corrs (refer 2nd chart).

Correlation swaps are clean but expensive in bid-offer terms to monetize this differential; instead one could consider a more liquid vanilla triangle composed of short EUR puts/NOK calls, short EUR calls/USD puts, and long USD puts/NOK calls with equal EUR notionals on the two EUR-legs, and the USD notional and strike of the USDNOK leg appropriately chosen based on those of the EUR-legs. Courtesy: JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -30 levels (which is mildly bearish), hourly USD spot index was at 139 (highly bullish) while articulating at (13:29 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One