The MXN should perform well until the end of this year on strong GDP growth in its biggest trading partner (the US), high positive carry, and diminished worries of NAFTA termination (risk premium has subsided but can fall further). The MXN will be boosted if inflation peaks and Banxico turns more growth friendly.

Our MXN-oil model suggests fair value is closer to 17.50 but in a risk-friendly world it can easily overshoot. Presidential polls for mid2018 elections will take center stage next year and risk reversals have started moving higher.

Key drivers: The debt inflow pace will likely increase if inflation shows signs of peaking. NAFTA negotiations are underway, and we put a low probability on a collapse of talks. Foreign investments should pick up when there is more clarity on the trade deal.

OTC outlook and hedging strategy:

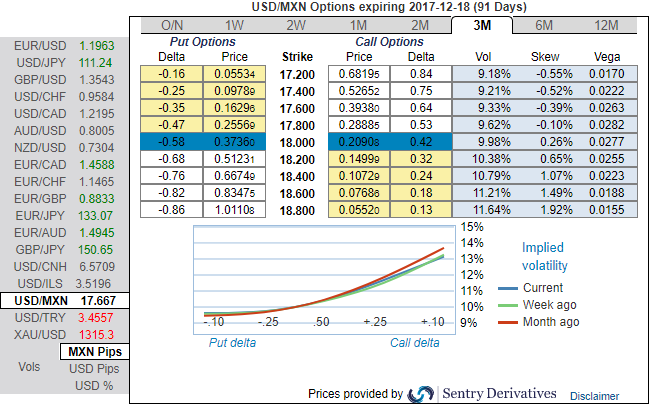

Please be noted that the 3m IVs of USDMXN are indicated bullish risks, the telling statistic from the graphic is that that the static carry of delta hedged vega-neutral 3M skews is a very substantial 2.5 vol pt., near the upper-end of its 2-yr range.

However, if you have to observe the technical trend of this pair, bearish sentiments have been mounting and more slumps are likey to test next strong supports at 17.1235 levels.

Thus, the foreign traders and the investors may become a little more nervous and take a cautious approach towards MXN engagements. USDMXN is likely to trend sideways again in the near future.

The peso has come a long way from its Trump lows and screens overbought and overvalued at current levels, leading our LatAm team to turn underweight recently.

The standout feature of the USDMXN vol surface to us is the cheapness of risk-reversals, both vis-à-vis ATM vols and particularly relative to the amount of carry in forwards that allows for carry efficient expressions of bearish directional views or tail risk hedges.

We advocate buying debit put spreads of 1m tenors with upper strikes at around 17.8939 levels, with OTM shorts at 17 levels.

Risks: Overall EM risk sentiment, higher UST rates or stubborn inflation could lead to heavy long position being unwound along with debt portfolio outflows. An unfavorable NAFTA outcome is certain to structurally impair the currency.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure